Vacant Commercial Property Insurance: A Comprehensive Guide

·

9 minute read

Commercial vacancy rates across the U.S. have skyrocketed in recent years, largely due to the fallout from the COVID-19 pandemic. Before 2020, the U.S. quarterly vacancy rate was about 12 percent. This number spiked during the global shutdown, and has continued to increase as remote and hybrid work becomes the norm. As of February 2024, the national office vacancy rate was at nearly 18 percent. Cities such as Detroit and San Francisco in particular are hurting, reporting commercial vacancy rates of 31.3% and 23.4% respectively during that same month.

As the uses and purposes of commercial real estate evolve, building owners need to carefully evaluate their insurance to be sure they are protected in this new world order. Vacant commercial property insurance can have small but significant differences, so here’s what’s important to know about your coverage.

What qualifies as a “vacant” property?

A vacant commercial property refers to a building or space (offices, retail stores, warehouses, factories, etc.) that is not currently being used for any business activities. There are a variety of reasons a building could be vacant, such as it being a new construction not yet ready to lease, tenants moving out, or low demand.

Whatever the reason, vacancy is a problem. Aside from the fact that an empty building is a financial drain on the property owner, the vast majority of companies will not offer commercial property insurance for vacant buildings. This is what building owner’s property insurance typically covers, and there are almost always exclusions for vandalism, glass breakage, water damage, theft, or attempted theft in buildings that are considered vacant.

Temporary vacancies (i.e. the unoccupied time between tenants) is an issue for insurance, but buildings vacant for over a year can lead to even fewer providers offering coverage.

Need help insuring a vacant building?

Request a call to get a vacant building quote!

Why is insuring a vacant building harder?

Obtaining commercial property insurance for vacant buildings is challenging because there is a greater likelihood they will be in worse shape than occupied buildings—meaning insurance providers must be willing to take on more risk and potentially pay out more claims. There are several reasons why vacant commercial properties are usually in worse condition:

Increased Vulnerability To Vandalism And Theft

With no one around to deter or witness criminal activity, vacant buildings are easy targets. These properties are more likely to suffer from intentional damage (e.g. graffiti, broken windows), theft of valuable materials (e.g. copper wiring, appliances), and squatting or other unauthorized occupation that leads to further damage.

Higher Chance of Undetected Damage

Small issues such as leaky faucets or malfunctioning appliances are often caught early in occupied buildings. In vacant spaces, these minor issues can worsen over time and become big problems. For example, vacant properties often have water damage from burst pipes or leaks, dangerous mold growth, and structural damage from unrepaired issues.

More Fire Hazards

Arson is more common with vacant properties because firebugs know that no one is around to catch or stop them. Additionally, electrical problems or malfunctions in empty buildings can go unnoticed, leading to fires that spread quickly.

Higher Public Nuisance Activity

In simplest terms, public nuisances are anything that negatively impacts neighborhoods. Vacant buildings often fall within this category because they attract activities such as illegal dumping, graffiti, drug and alcohol use, prostitution, transient crime, and more.

Increased General Neglect

The absence of regular maintenance and upkeep can lead to accelerated deterioration, making the vacant building more susceptible to a range of damages.

From an insurance perspective, all these factors add up to greater potential for losses as compared to occupied buildings. Hence the higher rates and stricter requirements for vacant property policies.

Why do you need vacant commercial property insurance?

As we just outlined in the previous section, there are still significant (or increased) risks even though people do not reside in your building. We strongly recommend that property owners obtain commercial property insurance for vacant buildings to:

- Gain financial protection. Even vacant buildings are valuable assets. If damage occurs due to unforeseen events, property owners need coverage to avoid paying high expenses out of pocket.

- Meet mortgage or lease requirements. Many lenders and landlords require proof of insurance for vacant commercial properties.

- Get liability coverage. Even with no active business operations, accidents can occur, and liability insurance can offer protection against potential lawsuits.

What coverages do you need on a vacant commercial property insurance?

While it’s important to speak with an insurance expert on the specific coverages you need for your commercial real estate, these coverages will most likely be essential for your vacant buildings:

- Commercial Property Insurance: Protects the structure itself against named perils, such as fire, theft, vandalism, and weather events (e.g. windstorm, hail, etc.). For example, if an arsonist starts a fire that damages the structure of a vacant building, commercial property insurance would cover the necessary repairs.

- General Liability Coverage: Protects the property owner against claims of negligence that result in injury or property damage to others. If a passerby is injured after a brick falls from a poorly maintained building exterior, or an visitor is harmed trying to repair wiring that is long overdue for a fix, liability insurance covers the medical bills and legal fees that would result from a claim.

- Business Interruption Insurance: Pays your business net-income and operating expenses during the period you're not generating, or not fully generating, income. This would come into play with a partial vacancy in your building.

Other common and optional coverages include equipment breakdown insurance if you have valuable tools and supplies in your vacant building, and property managers errors and omissions insurance.

How To Get Excluded Coverages Back Into A Vacant Commercial Property Insurance Policy

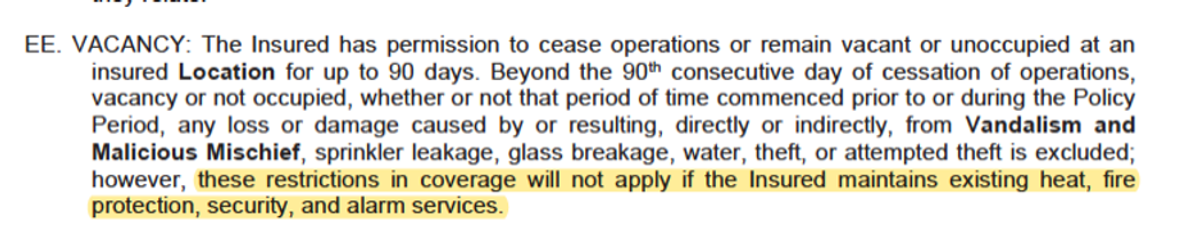

If you read your policy, you can figure out how to get coverage for vandalism, theft, and water damage. If you purchase a property policy that is set up to insure vacant properties, there will be instructions in the policy of how to get these coverages back. For example:

Tip To Lower Vacant Commercial Property Insurance Costs

There are certain actions you can take that will not only make it easier to get commercial property insurance for vacant buildings, but also make the premiums more affordable.

First and most importantly, implementing security measures will prevent incidents from happening in the first place and prove to insurance providers you are monitoring and caring for your property. For example, installing alarms and surveillance systems, holding frequent property inspections, and boarding up windows and vulnerable entry points.

Also, vacant properties are more insurable when property owners set up proactive maintenance routines. Preventative practices such as winterizing the property, keeping the building at optimal temperatures, monitoring the water pipes, and scheduling regular services (such as electrical and plumbing checks) are key to obtaining proper insurance coverage at the most reasonable price.

The Bottom Line

In the aftermath of the global pandemic, property owners and managers are facing new and unexpected challenges with occupancy rates and rising vacancies. We can help you get quality coverage for any property, vacant or not. LandesBlosch has over 100 years of experience in the insurance industry and has helped our clients protect their businesses in every type of economic climate. Contact us to get a free quote on commercial property insurance for vacant buildings today.

About The Author: Austin Landes, CIC

Austin is an experienced Commercial Risk Advisor specializing in and leading LandesBlosch's design professional, real estate, and construction teams.