Outside Directorship Liability Coverage - What Is It?

·

6 minute read

Outside Directorship Liability is insurance coverage on the Directors & Officers (D&O) Liability Policy. Its purpose is to extend coverage to certain additional organizations, usually non-profits, because an executive or officer of the insured company is serving on the outside organization’s board.

Protect your managers and executives

Opt for suitable liability coverage. Get your free quote today

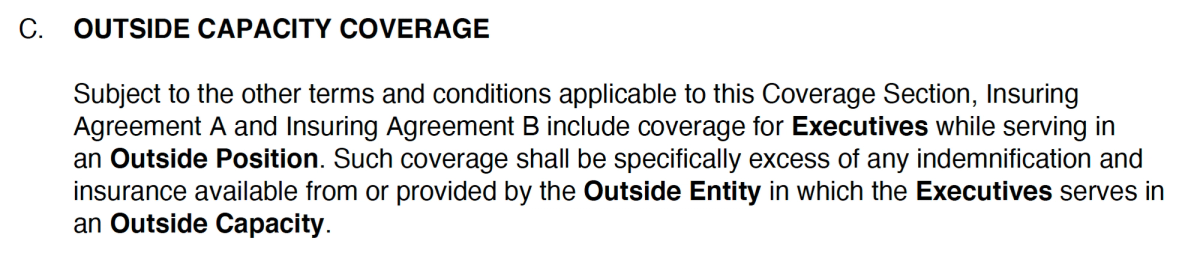

Although only a tiny portion of the D&O policy (usually only a paragraph long!), this inclusion provides significant protections to your company and your executives who serve on outside boards. Here is an example of the coverage section on a D&O policy:

In this particular example, the outside directorship liability coverage is referred to as "Outside Capacity Coverage."

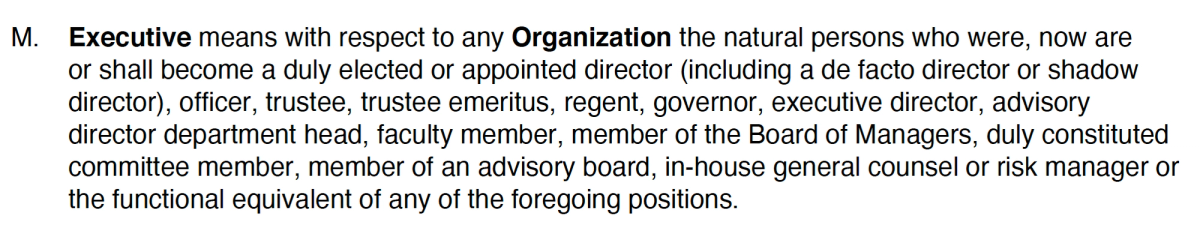

You will need to review your specific policy to determine who is covered and under what capacities they are covered. For example, look up the definition of “executive” to determine who is covered. This example policy defines it as:

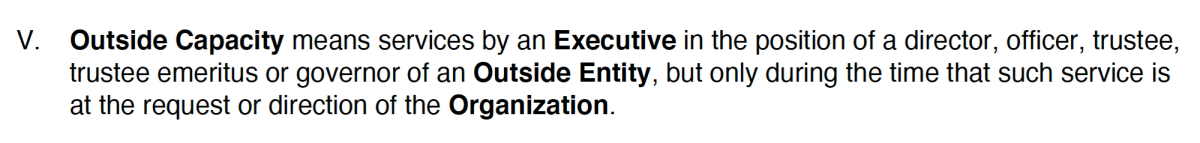

And this policy language covers executives who serve in "Outside Capacity" roles, which are defined as:

D&O policies are very customizable and can differ among insurance companies. We recommend reviewing your policy for specific definitions and only using these examples as rough guidance as to what a typical policy would cover.

If you want more information on who is covered under D&O and common claims that we see? Check out our guide to D&O insurance.

Why Do Companies Need Outside Directorship Liability Coverage?

Companies want their executives to serve on outside boards for multiple reasons, but here are some common examples:

1. Developing Leadership - Serving on the board of directors for a local non-profit is an excellent tool for companies to develop leadership skills and talent in their executives and company leaders. It gives executives the opportunity to network with other leaders in the community and gain the experience of making important decisions and leading an organization.

2. Supporting Charitable Organizations - It is no secret that the private sector holds some of the top talent in any given community, especially at the executive level. For this reason, businesses can not only to support charitable organizations financially, but give the time and expertise of their skilled employees to help non-profit organizations succeed.

3. Overseeing a Subsidiary Company - A parent company will commonly place a representative on the board or designate someone to be an officer of a subsidiary company to actively manage or oversee that subsidiary.

4. Managing Investments - If a company has a large financial investment in another company, they will frequently request a spot on the board of directors to actively oversee company operations and have input in decision making.

5. Helping Trade Associations - To gain industry influence or give back to an industry’s community, some companies will encourage their employees to sit on boards of their local or national trade associations.

These are just a few common examples—there are many more reasons that companies have their executives sit on boards of outside organizations.

Even though it is a common practice for executives to sit on outside boards, it doesn't come without risks. Some inherent conflicts of interest could lead to a breach of duty and ultimately actions that harm the employer's company and the employee themselves. By nature, in any transaction, you cannot have dual loyalties. Here are some examples of common allegations that arise from these inherent conflicts of interest:

Transactional Conflicts - If an employee of a company sits on the board of a non-profit or outside company and those two organizations enter into a transaction, that employee will be scrutinized as to whether they represented both organizations fairly to the best of their ability. This is a fine line to walk, and even a person’s best efforts could lead to allegations of favoritism toward their employer organization.

For example, let’s say a construction executive sits on the board of a non-profit and because of their deep relationship, is the executive’s company is hired by the non-profit to build a new facility. In that transaction, who does the construction executive represent? The non-profit or their own construction company?

Breaches of Confidence - As a board member of any company or non-profit, you have a duty to protect and safeguard any property of the company of which you are serving. This property includes confidential information.

Suppose someone sat on the board of two different companies and mistakenly inadvertently divulged information about either entity to each other. That accidental breach of confidence could be grounds for a lawsuit.

Business Opportunities - While serving on the board of two organizations, business opportunities might arise that could benefit both companies. Suppose one company gets an opportunity such as purchasing a business or real estate.

In that case, the company that first received the opportunity must fully decline the purchase before the board member can provide the other board the opportunity to purchase, or litigation could result.

Summary

Serving on multiple boards has unique liability implications for the board members and the companies that employ those board members. Outside Directorship Liability Coverage in your D&O Insurance policy can help you address these concerns by extending coverage to certain boards outside of the insured organization.

If you are wondering whether your policy includes this coverage or are looking for a policy that includes outside directorship liability coverage, let us know.

About The Author: Austin Landes, CIC

Austin is an experienced Commercial Risk Advisor specializing in and leading LandesBlosch's design professional, real estate, and construction teams.