Hiring a Contractor Without Insurance - What Are The Risks?

·

9 minute read

If you’re a homeowner, business owner, or real estate investor, your properties require maintenance. Roofs wear down, plumbing leaks, and sometimes you may want to remodel your space. In these cases, you will need to hire a contractor.

Hiring a contractor with general liability, automobile, and workers compensation is a must. Without it, you could be held responsible for any injury or damage your contractor causes.

Additionally, hiring a contractor without insurance limits your ability to remedy the damage caused by faulty construction, such as water damage or fire.

We suggest the following guidelines before unknowingly hiring a handyman or contractor without insurance.

What insurance should a hired contractor have?

Workers Compensation

The most important insurance that a hired contractor should have is workers compensation insurance. Hiring a contractor without workers comp insurance could leave you paying an injured employee or subcontractor’s medical bills indefinitely, just for hiring someone to fix your property.

While working on your project, your contractor or a contractor's employees could get hurt at your location.

Oftentimes, homeowners and business owners think while an injured worker is unfortunate, it is not their problem. However, if your contractor does not have workers compensation insurance, the workers compensation claim goes up to the “prime contractor” – in many states, that is the project owner.

You could be responsible for their medical bills and lost wages while they are unable to work, and your insurance might not cover this risk.

General Liability (With Products And Completed Operations)

Before hiring a contractor, you should make sure that the contractor has adequate general liability insurance coverage.

For example, if you hired uninsured contractors to paint your building, and they accidentally sprayed paint onto the neighboring properties and caused damage, you could be responsible for paying those damages. If the contractors had insurance, their insurance policies would cover the damage.

In addition to adequate general liability limits, you should verify that your contractor's insurance policy includes products and completed operations coverage.

Products and completed operations coverage handles damage or injury the contractor causes after the job is completed. This not only protects you from lawsuits arising from damages contractors cause others, but it provides you with a policy to collect from if the contractor's work causes you harm.

For example, let’s say you hired a contractor to build a balcony on your two-story house, and the work was completed six months ago. It looked great and worked fine when you went out on it. It wasn't until you had some guests over and multiple people stood out on the balcony that it collapsed and severely injured those who fell to the ground.

This would cause a substantial amount of medical bills and costs related to the fall. The products and completed operations coverage on your contractor's policy would cover your guests’ lawsuits, as well as pay for your medical bills if the deck caused you injury.

Without this coverage, you would most likely not be able to collect any money for your medical bills and you could be personally liable for your guests’ injuries. Additionally, if you are a homeowner, unless you purchased an umbrella policy, your homeowner liability limits are probably not high enough to cover the incident.

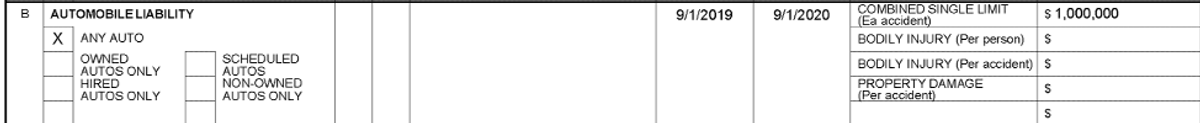

Auto Liability

Auto liability is overlooked coverage by many homeowners and business owners hiring contractors. Some contractors aren’t large enough to justify a fleet of work trucks, and some projects do not require this coverage. Look over your particular project to decide if auto liability is something you should add to your contractor requirements.

The primary reason we suggest adding commercial auto liability insurance to your contractor insurance requirements is for the loading and unloading coverage.

Contractors often have materials and tools in their trucks. If there was an accident while they were loading those materials in the truck or unloading the materials into your building, this would be an auto insurance claim and not a general liability claim.

What Insurance Should You Have?

Tell us about a little about your business and we'll send you a free quote.

How do I verify a contractor’s insurance?

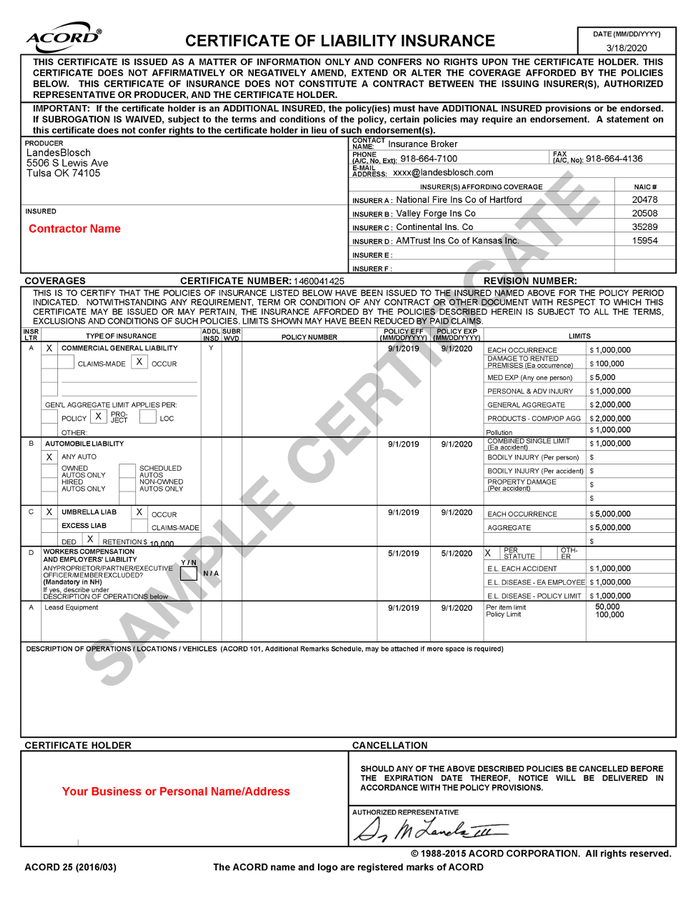

Verifying your contractor’s insurance requires a certificate of insurance. This is a document from your contractor's insurance broker that verifies they have coverage in place.

Name And Date Verifications

To make sure that you are not hiring a handyman without insurance, it is essential to verify that the proof of insurance provided by the contractor applies to your project.

Make sure the contractor’s name listed on the certificate is the correct name of the contractor you are hiring. If you are hiring "Excellent Plumbing, LLC," do not accept a certificate that has the insured listed under the owner's name.

Additionally, look at the date the certificate was issued. If that date isn't on or after the date that you requested the certificate, you cannot be certain that insurance is still in place.

Finally, an additional step of authenticity is to verify that your name is on the certificate as the certificate holder.

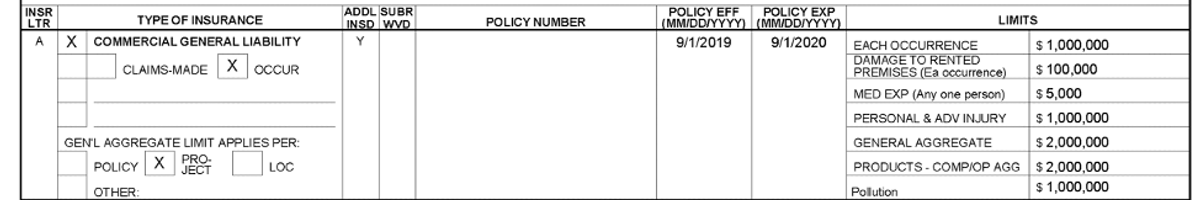

Verify General Liability And Completed Operations Limits

It is important to know that your contractor has adequate limits for the job. This is where you are going to see what limits they have. See “Each Occurrence” & “Products – COMP/OP AGG” for the discussed limits.

Since jobs range in all sizes and risk, we do not have a blanket suggestion for what limits a contractor should have before they start on your project. In this example, the contractor has a $1,000,000 per occurrence limit with a $2,000,000 products and completed operations limit. This specific contractor also has a $5,000,000 umbrella, giving them total limits of $6,000,000 per occurrence and $7,000,000 products and completed operations limit.

The larger your project, the more you will need additional limits to minimize your risk as a building owner.

Verify Workers Compensation And Auto Coverage

Verify that your contractor has workers compensation and automobile coverage by making sure that coverage is filled in and the limits look adequate.

Other Considerations

Cheap contractor bids often mean fewer protections.

When hiring a contractor, keep in mind that the cheapest bids can come at a cost.

It is often difficult for a contractor who is fully insured, has the quality protective gear, and adequately trains employees to compete against those who do not.

If you do take a low bid quote, verifying the insurance program becomes even more important in protecting your home or business from uncovered claims and lawsuits. The verification process is critical in trades in which the exposure to damage or injury is higher, such as roofing and framing.

Does your contractor hire uninsured contractors?

The same way that you verify that your contractor has insurance, your contractor needs to verify that their subcontractors also carry insurance.

How do you know if your contractor hires subcontractors? Just ask. It is important to make sure that anyone working on your building is fully insured, even if you don't directly contract with them.

If you are unsure where your contractor verifies insurance, require the subcontractors to provide a certificate or ask the contractor for copies of the certificate of insurance.

Does homeowners or business insurance cover this?

It could, but each policy is different. Many homeowners and business insurance policies will help you out in this scenario, but many don't.

In our article, “What Is A Business Owners Policy (BOP)?” we discussed how many insurance companies will add exclusions that apply to construction operations and subcontractors. If you have any questions about your policy, schedule a free call with a LandesBlosch Risk Advisor.

Even if your insurance program does cover this exposure, it should contribute only after the contractor's limits are maxed out and to pay your defense costs. This minimizes your exposure to out-of-pocket expenses that could put your assets at risk.

Summary

It is important not to assume your contractor's liability risks.

Hiring a contractor that is fully insured protects you from lawsuits arising out of contractor actions, but it also prevents you from suffering financially should the contractor damage your property or cause injury to you or others.

About The Author: Austin Landes, CIC

Austin is an experienced Commercial Risk Advisor specializing in and leading LandesBlosch's design professional, real estate, and construction teams.