Commercial Property Insurance: The Ultimate Guide

·

37 minute read

There are many types of commercial property insurance coverage: inland marine, builders risk, cargo insurance, or even cyber, to share a few examples. In this article, however, we are going to talk about the commercial property insurance policy, coverages found in this policy, and the various options you have when purchasing.

Specifically, we will review the coverages found on the most common commercial property insurance policy form used in the United States. It’s called the CP 00 10 - Building And Personal Property Coverage Form.

There are three types of property that this policy will pay claims on: your building, your business personal property, and personal property of others. Here is what each means:

What is covered under commercial property insurance?

Your Building

Without sounding too obvious, this coverage part insures the buildings list on your insurance policy.

The building can be a structure that you own or a property that you do not own but are responsible for insuring (referred to as a triple net lease).

In addition to the actual structure, building coverage insures the following parts of your building:

- Completed additions

- Fixtures (including outdoor fixtures)

- Permanently installed machinery and equipment

Your Business Personal Property

The second coverage in a commercial business property insurance policy is the business personal property (BPP) section. This section of the policy doesn't cover the building (unless you are a tenant that has made permanently installed improvements to your rented space), but it covers the building’s contents. Here are a few examples that the policy lists:

- Furniture and fixtures

- Machinery and equipment

- Stock

- All other personal property owned by you and used in your business

- Tenant’s improvements and betterments (upgrades made to a rented space)

- Leased personal property for which you have a contractual responsibility to insure

It is essential to note that most commercial property insurance policies only cover personal property in or within 100 feet of the insured building.

LandesBlosch Tip: A quick way to determine what is included under the building vs. business personal property limit is to imagine picking up the building, flipping it upside-down, and shaking it. Whatever fell out qualifies as business personal property. The remaining building and permanently installed features of that building would be covered under your building limit.

Personal Property of Others

An overlooked yet important coverage part of the business property insurance policy is coverage for the property of others in your care, custody, and control. This could mean property that you are borrowing or even customer’s property.

Similar to the business personal property coverage, this coverage only applies to property within 100 feet of the insured building.

Additionally, if you were to turn in a claim under this coverage, it will only pay the owner of the property and not yourself.

Need to control the costs of coverage?

Our team can help. Get a call in 28 seconds and talk to an expert. Available in most states.

What types of damages are covered under the commercial property insurance policy?

Now that we know what property is insured, we need to talk about what perils this policy insures your buildings against.

This is tricky because not all insurance policies are created equal. One of the most common and easiest to spot differences between a great and not-so-great commercial property coverage is the causes of loss form.

This form is the core of which events are covered and which are not.

Although a little technical and unexciting, it is crucial to know what perils your building will be covered against. This will not only give you peace of mind; it also allows you the opportunity to prepare.

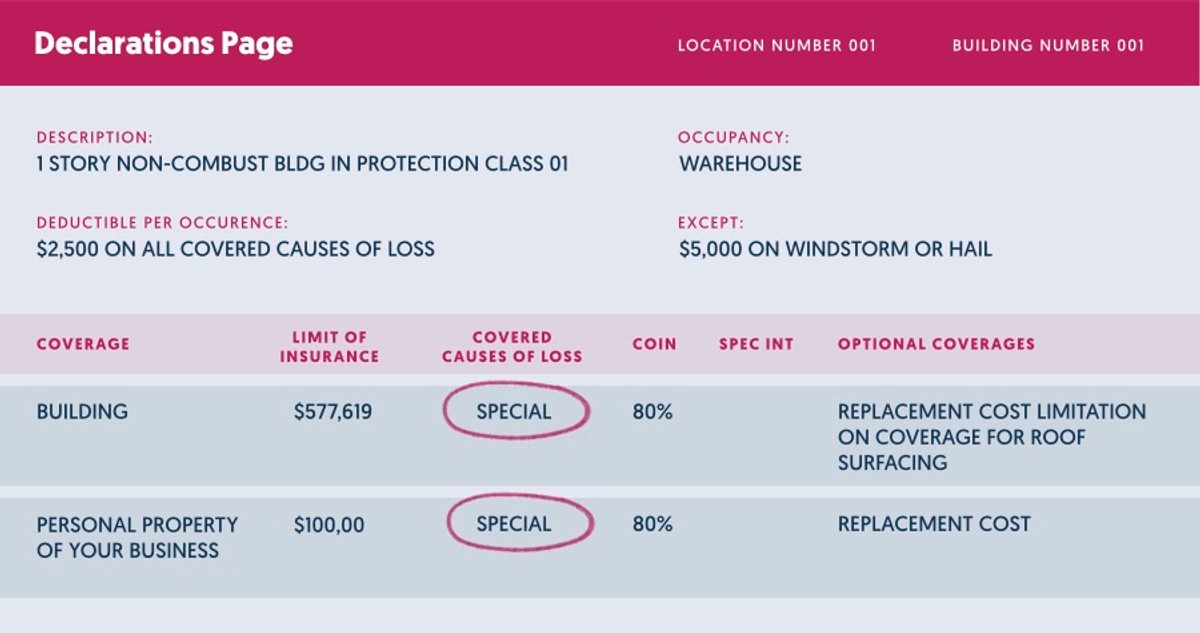

You can generally locate the causes of loss form your policy or quote has on your declarations of insurance page. Here is an example:

The different options you will generally see are special, basic, and broad.

Here is what each of the three forms means for your business:

Special Cause Of Loss Form (LandesBlosch Recommended)

The special causes of loss form offers the best coverage of the three coverage forms. Now, why do we always recommend this coverage on your property insurance policy?

If you look at all the causes of loss forms, both the basic and broad forms offer a list of what events they insure against (don’t worry; we will go over those lists shortly), but what makes the special form so special, for want of a better word, is that it covers all direct physical damage to your property unless excluded.

A short summary of what we mean by this:

Special Causes of Loss Form = Everything covered unless excludedBasic & Broad Causes of Loss Form = Everything excluded unless included

This is why the special form is often referred to as an "all-risk" policy; it covers all direct physical damage unless specifically excluded. However, the insurance industry is slowly starting to drop that term because it is misleading. There are in fact exclusions!

As you can see, this gives you quite a few advantages. First, you start from a place of all direct physical damage being covered. Instead of a list of covered events, you have a list of exclusions. Having everything covered unless excluded covers a broader area of potential claims.

Finally (and arguably most importantly), the special form shifts the burden of proof to the insurance company to deny a claim. In the court of law, if everything is excluded unless covered (broad and basic forms), you have to prove why your loss was one of the listed perils that are covered.

To contrast that, under the special causes of loss form everything is covered unless excluded. The burden of proof is switched to the insurance company, which has to prove that your claim was excluded. This gives you the upper hand (and a higher probability of getting your claim paid).

Basic Cause Of Loss Form

Although we recommend purchasing the special form for all our clients, sometimes the market won't offer the special form. Some of the reasons why include property condition, vacancy, or loss history. Here are the perils the basic causes of loss form insures against:

- Fire

- Lightning

- Explosion

- Smoke

- Windstorm

- Hail

- Riot

- Civil commotion

- Damage caused by an aircraft or vehicle

- Vehicles

- Vandalism

- Sprinkler leakage

- Sinkhole collapse

- Volcanic action

Broad Cause of Loss Form

The broad form is in between the special and the basic form. In a nutshell, it adds additional perils the policy will cover to the basic form. The broad form covers everything in the basic form, plus:

- Falling objects

- Weight of snow, ice, or sleet

- Water damage (in the form of leakage from appliances)

- Collapse from specified causes

But what if the policy isn't special, basic, or broad?

Although the vast majority of insurance policies follow the special, basic, and broad labels, you may occasionally find some that do not. Usually, this could be a proprietary form specific to the insurance company you are purchasing from, or a manuscript form called something like "All Risk Manuscript Form."

Unless you are an insurance expert yourself, we suggest either avoiding these non-standardized policies or consulting with an experienced insurance broker who can help you review them.

Sometimes (usually as part of a niche industry program) a proprietary policy can be more robust than even the special causes of loss form, but most of the time it is customized to the detriment of the policyholder in that it limits coverage.

What is typically excluded from commercial property insurance?

Now that we understand the causes of loss form, let’s talk about special form exclusions. We’ll focus on the special form because it’s a popular policy and any exclusion on the special causes of loss will also be included on the others.

Here are a few examples of exclusion you will see on almost all property insurance policies:

- Flood

- Earthquake

- Terrorism

- War and military action

- Intentional damage

- Nuclear hazard

- Normal wear and tear

You’ll need a specialized and separate policy if you want to cover some of these exclusions. If you live in a low-risk area, your insurance company may offer some limited coverage for specific perils, but this is a rare occurrence.

When it comes to exclusions like intentional damage and normal wear and tear, you will never find an insurance policy that will cover them. It’s just not an appropriate risk for a commercial property insurance policy.

Recommended Additional Coverages

Although insuring your building and business personal property will create a great foundation, you will most likely need some additional coverages to create a well-rounded insurance program. Here are some popular options recommended by LandesBlosch.

Business Income & Extra Expense

As we mentioned in our insight, "Business Interruption Insurance - What's Covered," business income is one of the most important coverages for businesses to purchase on their commercial property insurance policies.

This coverage pays for your net income, employee payroll, and normal operating expenses while your business is non-operational (or losing income) due to a covered claim.

Since an event like a hurricane or a fire could potentially cause you to close your doors for months or years, this coverage is essential for keeping your bills paid, helping you relocate, and paying your essential employees during the downtime.

Equipment Breakdown (Boiler And Machinery)

While the building policy does cover direct physical damage to permanently installed machinery and equipment, it doesn't protect against perils specific to such machinery.

Here are some of the items that would fall under this category:

- Heating and air conditioners

- Refrigerators

- Electrical systems

- CNC machines

- Boilers and pressure equipment

- Elevators

- Manufacturing equipment

- Motors and engines

This type of property faces perils that can cause a very different kind of loss than you would expect from a building. It requires specialized coverage to insure this machinery against:

- Explosions

- Electrical surges

- Electric motor burnout

- Sudden and accidental damage

In addition to repairing or replacing the broken machinery, there is commonly a business income component built into the coverage that will pay you the lost income you would have made from that piece of equipment while it is non-functioning.

Generally, this coverage is a great value for your money and a tiny fraction of your overall property insurance costs.

Ordinance and Law

An insurance policy states that if a covered building claim happens, the insurance company is obligated to replace your property with a building of similar size, quality, and construction. That is great! The insurance company now has to build you a brand-new version of the same building.

But if the building they’re replacing is 20 years old, there’s a good chance the local building codes have changed drastically.

Since the insurance company only has to replace what was destroyed, they aren't obligated to upgrade the electrical and plumbing to now bring it up to code. Without ordinance and law coverage, that expense would be out of your pocket.

Additionally, if your building isn't up to modern code or if only part of your building is damaged, the local government will sometimes force you to demolish the remaining part of your building entirely.

Now you have an even bigger problem. The insurance company only replaces damaged property with a similar new property. It does not demolish and replace the undamaged property that the city forces you to knock down! This could be a huge, uncovered expense.

Ordinance and law coverage was created to fill in this coverage gap. It will pay for the upgrades and changes required to bring your building up to code, any demolition costs, and the costs associated with rebuilding the undamaged portions of your building.

Find Out How You Can Afford Additional Coverages

Our team is ready to help you insure your property.

How do I value my property for commercial property insurance?

Arguably one of the most important questions when purchasing an insurance policy is, "How much money will I get if my property is destroyed?"

You will find the answer in your limits of insurance. But first, you need to know what type of property limit you purchased. There are three common choices: replacement cost, actual cash value, and functional replacement cost. Each will drastically affect how much cash you have to rebuild or replace your property.

Here is how they work:

Replacement Cost (LandesBlosch Recommended)

Replacement cost valuation is the most popular and our recommended coverage for almost any property you can think of (both building and business personal property). Most of the time, if you see an insurance policy, it will be on a replacement cost basis unless no insurance company will offer it; this is usually because the property is in poor shape or something is wrong with it.

Replacement cost replaces your property with new construction and does not account for depreciation.

This is the most objective and simple claims scenario. To determine how much will get paid on a claim is simple. Get quotes from different contractors to repair or replace the property with new material minus the deductible.

It is also a way to ensure that if your property is damaged, you are only out the deductible amount and not a huge unplanned repair bill that you might or might not have the money for.

Actual Cash Value

Actual cash value (or ACV) is commonly cited as replacement cost minus depreciation. This means you take whatever the contractor quoted you to replace the damaged part of your property and deduct the percentage of the total life that part of the building would have had.

Do you see how this could easily not go smoothly?

The amount you will receive is dependent on what the claims adjuster believes the depreciation should be.

It gets even more complicated, though. Many states have rules determining how insurance companies can depreciate the useful life of a property, making things even more unclear.

One thing is clear: Chances are you will be on the hook for a lot of the damage, and you will be unsatisfied with the claims experience. This is why we don't recommend ACV unless the insurance market forces you to go that route.

Functional Replacement Cost

What if you own a unique building with a significant amount of decorative hand-carved stone? What if your property is constructed with incredibly rare materials or with construction techniques only a few companies in the world still specialize in?

Your options are to either build all those costs into your replacement cost value, get terrible coverage with ACV (remember your building is old, and the depreciation will be significant!), or switch to the functional replacement cost valuation.

Let’s revisit your unique building with its rare décor. What happens if a loss occurs, but you don’t care about the ultra-rare materials the building contains? Functional replacement cost coverage allows you to get replacement cost, but during the work, you can replace the super-rare material and obsolete construction methods with modern, less costly, and functionally equivalent materials and construction.

This allows you to save significantly on your premium while also being assured that your business or organization will have a new building if a disaster occurs.

Penalties For Underinsuring Your Property

Lowering the building property limit of insurance is a common method people use to reduce their property insurance costs. Since pricing is determined by multiplying a rate by the amount of property insured, this could indeed lower the price of insurance.

But this tactic has consequences. You are liable to run into coinsurance penalties that could significantly harm your claim outcome, and not just coming up short on rebuild costs.

How Coinsurance Penalties Work

A coinsurance penalty is a penalty for underinsuring a piece of property; it means you now have to pay the percentage of the claim that you underinsured.

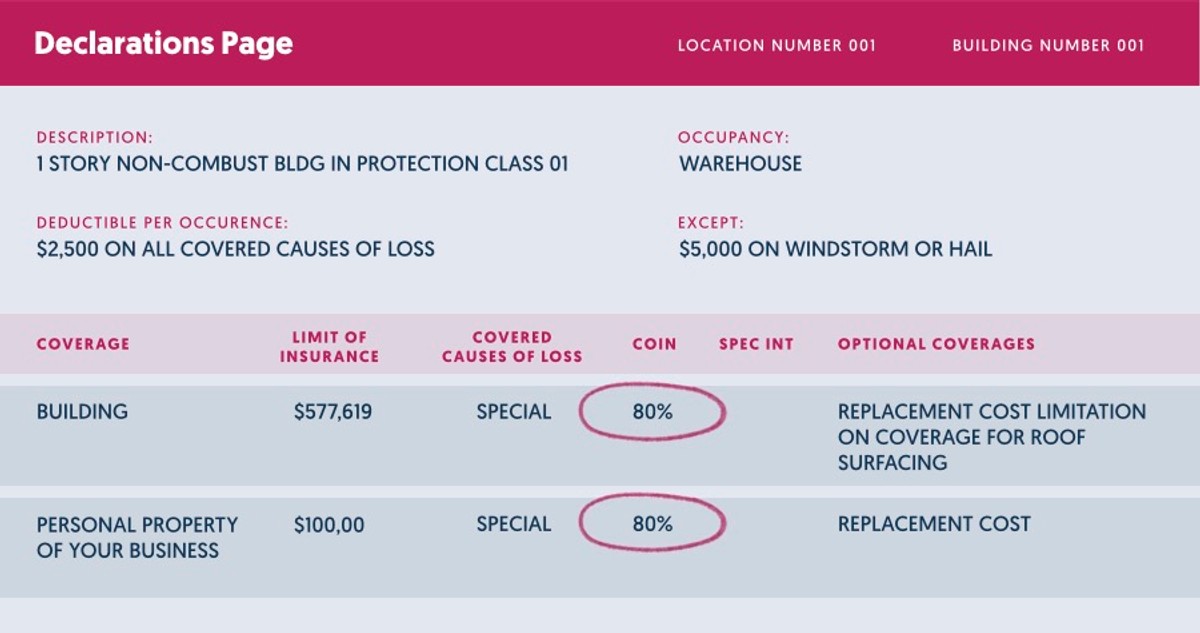

Of course, it isn't always that simple, and there are also different levels of coinsurance penalties to consider. They are 80%, 90%, 100%, and waived coinsurance.

You can find the level of your coinsurance on your property declarations page. Here is an example:

The percentage amount on the coinsurance clause is the amount that you are promising the insurance company you will insure the building to value. Putting down “100%” means that you promise to list 100% of your building's replacement value, whereas “80%” means you will insure your building up to 80% of the full replacement cost without a penalty.

The lower the percentage, the more room for error you have in calculating the replacement cost.

The formula for determining how underinsured you are is as follows:

Amount of insurance you purchased / Amount you should have purchased = % Underinsured.

After you calculate the percentage underinsured, you multiply the amount underinsured by the total claim amount.

Total claim amount X % underinsured = Amount insurance company will pay

The claim penalty is the dollar amount you are now responsible for paying in a claim. Remember that the policy will still only pay up to the policy limit.

Here’s an example. You have a piece of property with a replacement cost of $1,000,000. You insure that property at a value of $500,000. You then have a claim with the total damages equaling $250,000.

Here are how the penalties would play out:

100% Coinsurance

$500,000 / $1,000,000 = 50% underinsured

$250,000 x 50% = $125,000 payment

Your insurance will only pay for $125,000 of the $250,000 claim.

90% Coinsurance

$500,000 / $900,000 = 56% underinsured (remember that with a 90% coinsurance clause, you only agree to insure 90% of the building value to soften this penalty)

$250,000 x 56% = $140,000 payment

Insurance will only pay for $140,000 of the $250,000 claim.

80% Coinsurance

$500,000 / $800,000 = 63% underinsured

$250,000 x 63% = $157,500 payment

Insurance will only pay for $157,500 of the $250,000 claim.

Agreed Amount Or Waived Coinsurance

You can purchase an endorsement that waives all coinsurance penalties, where the policy will pay out the limit no matter how underinsured you are. This is called "Agreed Amount" or "Waived Coinsurance."

The policy would pay for the full $250,000, resulting in no penalties.

That being said, underwriters will not agree to this endorsement unless they are certain the building is insured to the appropriate value or very close to it.

LandesBlosch Recommendation: Ask for "Agreed Amount" or "Waived" coinsurance. As you can see, getting waived coinsurance will always work in your favor during claims time. It requires the insurance company pay the full repair bill until the limit has been reached. Even if you cannot get this coverage, we always suggest requesting it.

In addition to the massive ramifications you could face from underinsuring your buildings, chances are you are killing your cost-to-value.

Insurance underwriters evaluate buildings for a living. They can usually figure out when games are being played with the valuation of a property.

Sometimes instead of arguing with the broker or building owner about the valuation, they will increase the rate so they get the desired premium for the size of the building. As a result, you are paying close to the same premium but are now responsible for all those penalties we just discussed.

LandesBlosch Recommendation: Increase your deductible instead of lowering your building limit. If you are looking to lower your property insurance premium, the best way to do it is to increase your property deductible. Since underinsuring your property can be functionally the same as increasing your deductible (due to coinsurance penalties), we believe increasing the deductible creates a more predictable claim outcome and will save you more money than just underinsuring the building.

Different Types of Property Limits

Now that you understand the different ways to value a commercial property in each insurance policy, you will have a couple of choices on what limit to select. These are a blanket property limit and a scheduled building limit.

The Blanket Limit (Recommended)

If you own multiple buildings, a blanket limit is generally a good idea. What a blanket limit does is take the value of all your different properties and adds it into a single limit that can be used to cover any property.

It gives you more room for error in estimating the replacement cost of your property, since you can use the limits from other properties if you accidentally underinsure a building in your portfolio.

Although some policies allow complete freedom to underinsure the properties without consequence, many insurance companies are now adding a "margin clause" to policies that states the insurance company will pay no more than 110% or 125% of the individual building value reported on the annual statement of values, limiting the possibility for abuse.

We still believe that a blanket limit with a margin clause is superior to individually scheduled building limits because it leaves you more room for error if you underestimate your building's value.

LandesBlosch Recommendation: Depending on your property portfolio, a "Per Occurrence Loss Limit" could be a smart way to save on your insurance premium. A per occurrence loss limit takes your entire building portfolio and assigns a limit that you choose to be the maximum the policy will pay in any one occurrence. This is a great way to save money if your properties are geographically spread out in such a way that no storm of catastrophe could reasonably affect your entire portfolio. For example, if you have 10 properties each worth $1,000,000, and each building is 100 miles apart, you could set a per occurrence loss limit of $3,000,000. This is because there is almost zero chance of one storm destroying three of your buildings.This method could lower your premium significantly while affecting your coverage very little.

The Scheduled Building Limit

Individually listed buildings with separate limits of insurance are referred to as "Scheduled Limits of Insurance." If you own only one building, this would be your only choice; if you own multiple buildings, this would be the lower-cost option.

This limit allows you to select a limit of insurance for each building individually. Each limit represents the maximum the insurance policy will pay out per building. Unlike the blanket limit of insurance, there is no sharing of the limits if you accidentally underinsure a property.

Deductible Types & Amounts

When most people think of their deductible, they think about how much they will be out of pocket if a claim occurs. In theory, this is the correct way to think about it, but there are different types of deductibles that, depending on your property portfolio, could lead to a situation where you are paying for more than what you thought you would.

The Different Deductible Types

Per Building Deductible: The first deductible type is the "Per Building" deductible. This is the deductible in the policy contract that states you are responsible for the deductible on a per building and per loss basis. This means your deductible resets for each building and each damaging event.

This is a common type of deductible that makes sense for a lot of commercial property buyers, including those who:

- Only have one building.

- Have multiple buildings that are far apart from each other (where no one storm could damage both buildings).

- Have a deductible based on the replacement cost of the property.

- Are prepared to pay for the deductible for however many buildings are insured.

Many times (especially for small businesses), this will be the only type of deductible offered since only certain insurance carriers will offer a per occurrence deductible. That being said, for many businesses it wouldn’t make a difference anyway. For example, only having one location or building make the per building and per occurrence deductible the same. The most important part is that you know the potential outcomes and are prepared to pay the deductible for each building.

Per Occurrence Deductible (Recommended): The per occurrence deductible is the superior and simpler deductible type of the two (and in many cases, the most expensive).

The per occurrence deductible is the total amount you will be responsible for per event, no matter how many buildings were damaged or what the damage is.

If you are given the option of the two deductibles and they are both the same price, we would recommend the per occurrence deductible, but that might not be the most cost-efficient choice for many businesses.

Choosing A Deductible Amount

When choosing a deductible, the per building or per occurrence deductible isn't always your only option. If you are in a coastal or high-wind state, you might be offered a deductible on a percentage basis or a flat amount of money. Here is how they work:

Flat Deductibles (Recommended): Flat deductibles are what we prefer to use since they are the most straightforward type. The premise is that if your building suffers damage, you are only responsible for a specific dollar amount (e.g. a $5,000 deductible).

Percentage Deductibles: The alternative to a flat deductible is a deductible as a percentage of the building value. Usually, when the wind and hail deductible is separate from your standard property deductible (which we will go over shortly), this deductible will be 1%, 2%, 3%, or 5% of the total building value.

If the building value goes up, so does the deductible. If your policy has a percentage deductible, chances are the deductible is very high and you are in an area prone to tornados, hurricanes, high winds, or hail.

Deductible Buy Down Policies: Some commercial property insurance policies have incredibly high deductibles, which has led to a new type of policy called the deductible buy down.

Suppose you have a deductible that is $100,000. If you want a $10,000 deductible and the insurance company is unwilling to go any lower, you can purchase an insurance policy that would pay the difference between $10,000 and $100,000 to lower your deductible amount to the desired level.

My policy has a wind and hail deductible – what is that?

In some parts of the U.S., wind or hail claims account for the vast majority of property claims in both frequency (the number of claims) and severity (the dollar amount per claim). It is not sustainable for insurance companies to have low deductibles on these risks, but just because insurance companies need a higher deductible on wind and hail risks doesn't mean they need one on every other claim type.

That is why the wind and hail deductible exists. It allows you to maintain a low property deductible while also allowing the insurance company to have sustainable deductibles on certain risks with high frequency.

Watch Out For These Red Flags In A Commercial Property Insurance Policy

Protective Safeguard Endorsements

When initially filling out the application for your commercial property insurance, you will be asked whether the building has certain protections that lower the risk of claims. Protections such as sprinkler systems, burglar alarms, and many others will get you a discount on the insurance policy, but sometimes that discount will come with a "Protective Safeguards Endorsement."

Let’s take a fire sprinkler system as an example. You report that you have this system in place and accept the discount. If, at the time of loss, it is determined that you do not have this sprinkler system, the insurance policy will not pay for the fire damage.

Additionally, the exclusion goes even further. If you have the fire sprinkler system in place but it didn’t function properly due to poor maintenance, the insurance policy will still not pay for a fire claim.

As with anything, sometimes mistakes happen. A safeguard may be removed during construction, or you may have neglected to maintain a system. Putting yourself in a situation where a total loss could be denied in exchange for a 2% discount (usually the discounts are not substantial!) is not worth it.

Theft Exclusions

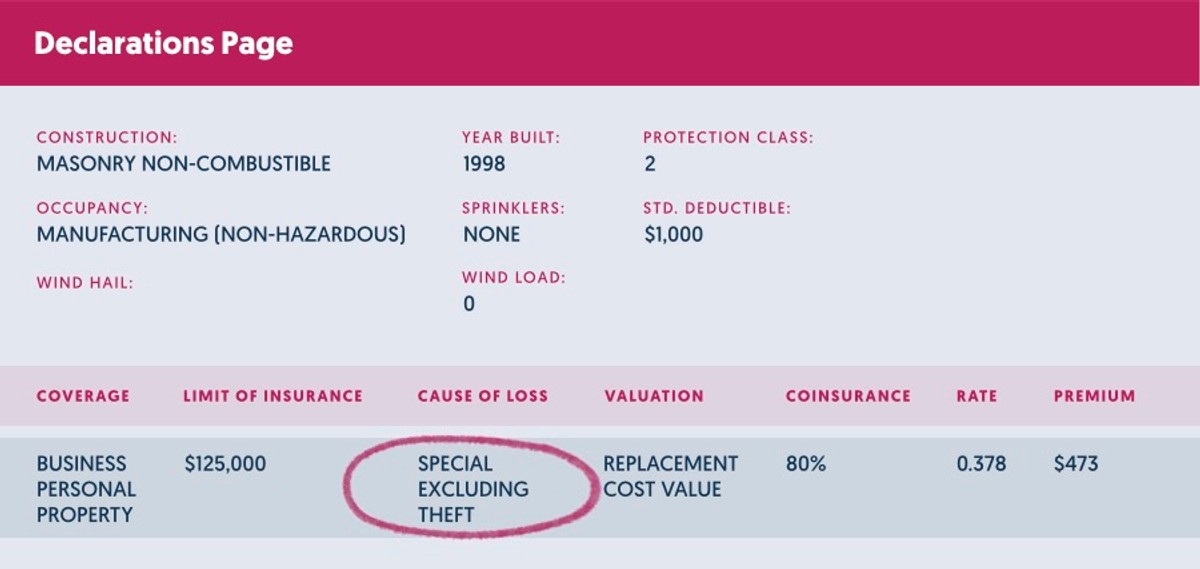

So far, we’ve talked about the differences between basic, broad, and special causes of loss forms. If you take our advice and get the special form, sometimes you have to make sure that theft is still included.

It is now common for insurance companies, especially excess and surplus lines insurance companies, to provide the special form (our recommended) while excluding theft. On your insurance policy, it will say "Special (Excluding Theft)".

Make sure that you do not have this on your policy, especially if you have significant amounts of contents inside your building that could get stolen. Here is an example of this exclusion and what to look out for:

ACV Roof Limitations

This endorsement is unavoidable in many states. That being said, you should still know how it will affect the claim payment on a property that you own.

In states that endure heavy winds, hurricanes, tornadoes, and hail, this endorsement gets added if your roof is over 10 years of age. What this endorsement does is take the replacement cost of your roof (what you would pay for it brand-new) and subtracts depreciation from the claims payment.

Over time, insurance companies have noticed that most of their roof claims were derived from roofs that were more than a decade old and needed to be replaced. The older the roof, the more likely it is to get damaged from certain wind- and hail-related events.

Cosmetic Damage Exclusion

Similar to the ACV roof limitation endorsement, the cosmetic damage exclusion is aimed at limiting the number of claims generated from certain roof types.

In this case, this endorsement excludes claims that are cosmetic only. This means if your roof looks damaged but still functions as intended, the insurance policy will not pay for a claim.

This is a popular endorsement to use on metal roofs since hail can and does ding them up without actually affecting how they function.

Why are my commercial property insurance rates going up?

There could be many reasons as to why your insurance renewals are going up. It could have something to do with your claims history or individual properties, but there are some common things we see that affect rates across the board. The reality is that most property insurance premiums are going up for a combination of the following factors:

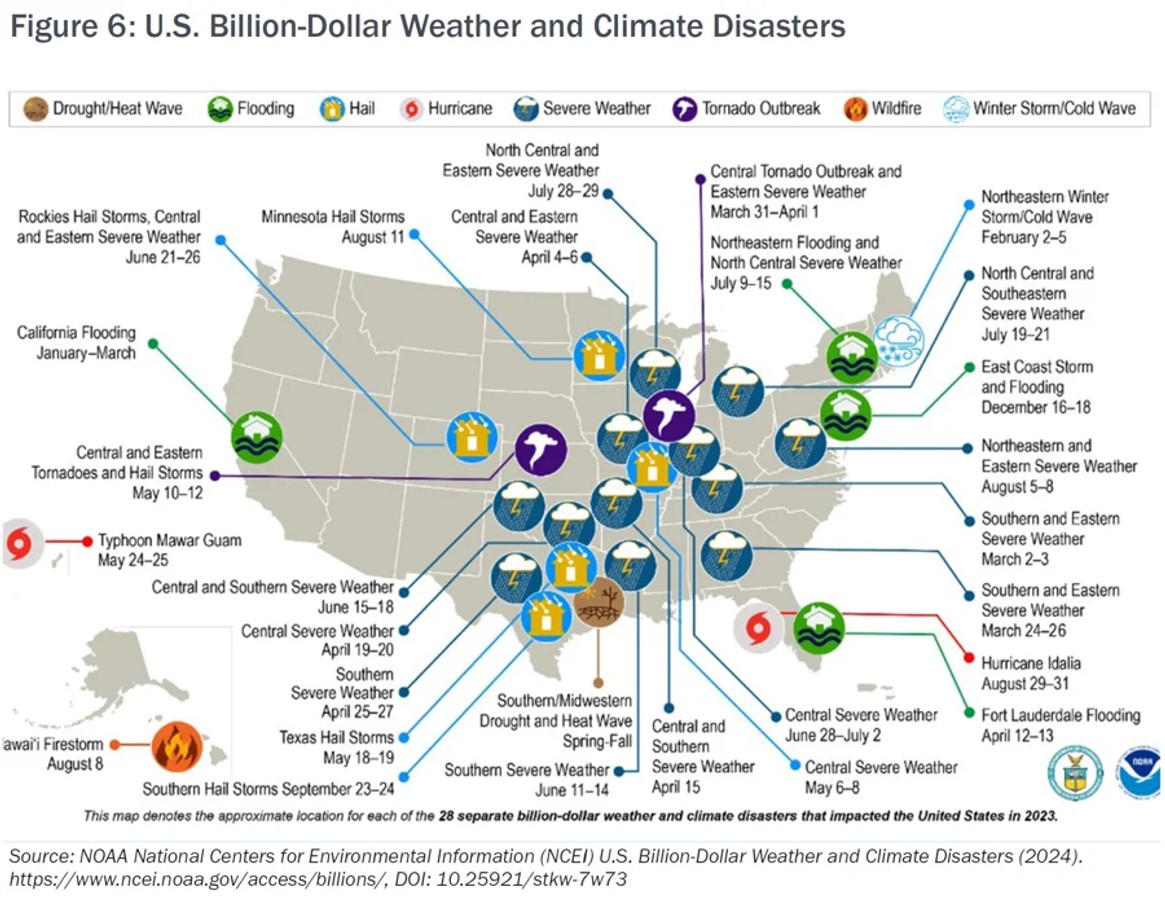

There have been a record number of natural disasters in recent years.

According to the National Oceanic and Atmospheric Administration, 2023 saw a 28 billion-dollar-plus weather and climate disasters in the United States.

Here is a visualization found on their website:

The damage totaled approximately $95 billion.

In 2024, insurance companies are adjusting rates because natural disasters like storms and wildfires are happening more often. These events are causing significant losses, so insurers are raising deductibles and setting stricter terms. They’re also using better data to predict risks and manage claims as extreme weather continues. The goal is to keep up with the rising costs caused by these disasters while staying profitable.

The rate increases that we have experienced over the last couple of years have helped the insurance industry keep up with this increase in storms, making the upcoming changes less dramatic than what insureds have seen in the past.

Construction materials, labor, and professional service costs continue to rise.

Although often overlooked, one of the primary reasons why property insurance gets more expensive over time is that construction costs become more expensive over time.

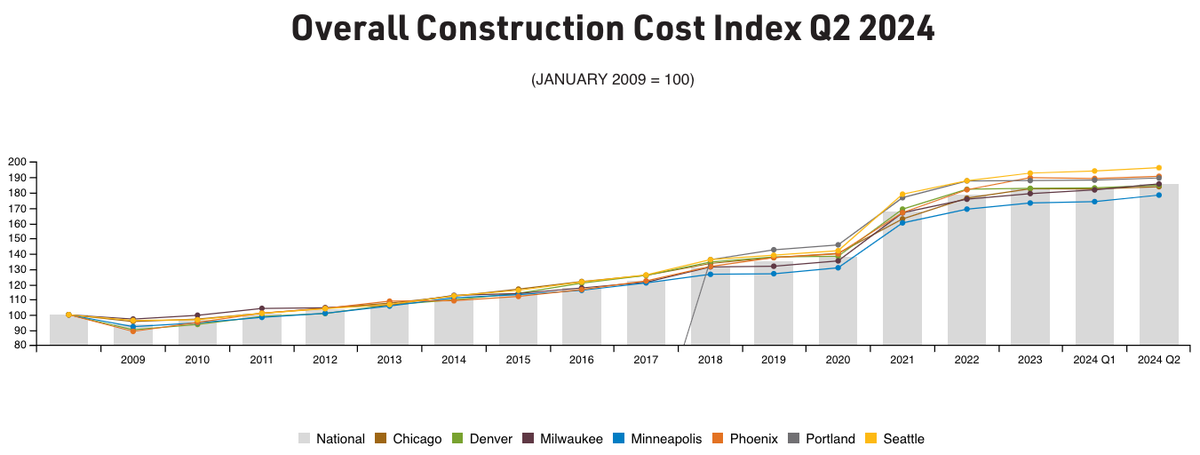

If you look at the graph below, you will see that in some instances, construction costs have increased nearly 45% in the last 10 years.

Source: Mortenson Construction Cost Index

With these construction costs increasing, insurance companies can't offer the same price every year while construction costs continue to increase. Every insurance company would either stop writing property insurance or go bankrupt.

It’s not the only reason, but it is a big part of why you might see a 3-4% increase each year even without any catastrophic events.

In 2024, you can expect…

We have talked about why rates are increasing, but what exactly does that mean for your business? According to the latest Property Market Outlook report from Risk Placement Services, commercial property insurance customers will feel the following effects:

- Market will continue to stabilize compared to the last 3 years.

- More capacity for challenged areas such as hurricane & wildfire.

- Carriers might consider writing higher limits per risk. For example, if a carrier was only willing to offer $5m limits, they might offer $7.5m this year.

The rate of change has slowed down considerably compared to what we have seen in the past couple of years. You can expact a more stable market, less dramatic rate increases, and more carriers in the market. While you shouldn't expect any major improvements or changes, this leveling off is a good sign for insureds.

Did you receive a large increase on your property insurance? Is your broker not proactive toward the shifting marketplace? Do you want a second opinion? Let us know! We’d be happy to give you a hand.

About The Author: Austin Landes, CIC

Austin is an experienced Commercial Risk Advisor specializing in and leading LandesBlosch's design professional, real estate, and construction teams.