Workers Compensation Experience Modifiers: What You Need To Know

·

8 minute read

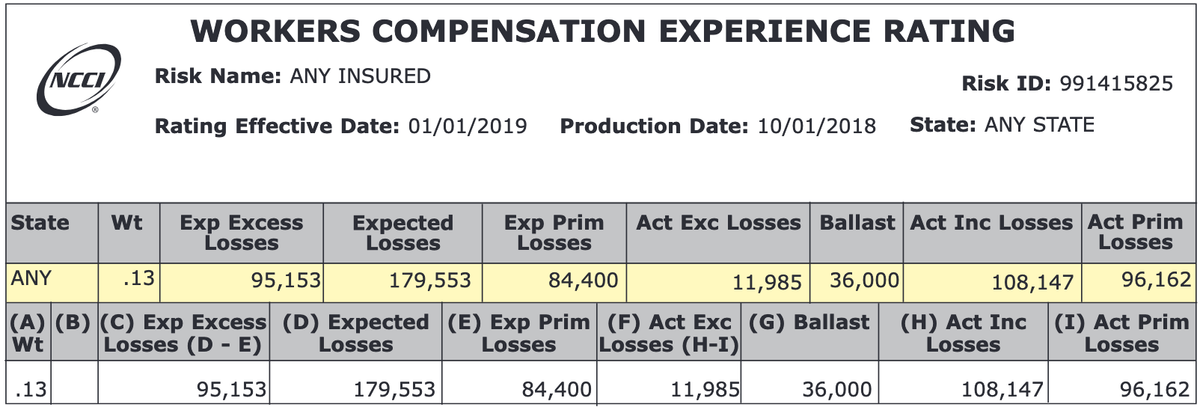

Every year this workers compensation document arrives in the mail.

You probably don't spend a significant time reviewing it, nor does it make any practical sense.

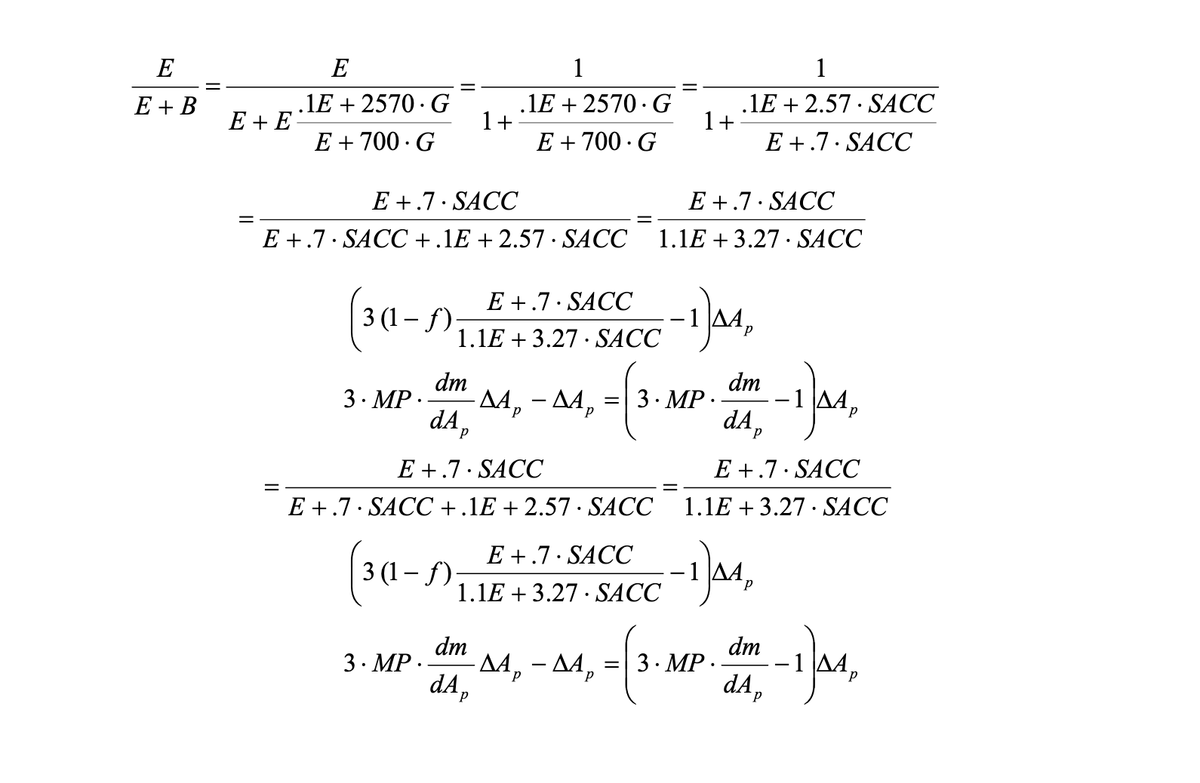

Do you know what this formula really means for your business? Or do you feel how most owners feel -- in the dark.

If you look over the formula, is it a wonder why most business owners feel this way?

The reality is that your experience modifier can drastically impact your annual workers compensation premium and result in negative consequences from OSHA or various contract requirements. For most - the only experience business owners have with their modifier is negative, but it can also help your business and increase your profits -- if you know how it works.

Find The Workers Compensation Carrier That Works For Your Business

Fill out the form below to get your free quote today!

What is an experience modifier?

An experience modifier is a formula created by the NCCI that compares the claims profile of your workers compensation policy to the claims profile of other companies of similar size and industry.

This formula outputs a number that is called the experience modifier (often referred to as an EMOD, EMR, or XMOD). It is a statistical indication of the amount an insurance company surcharges or discounts your workers compensation premium.

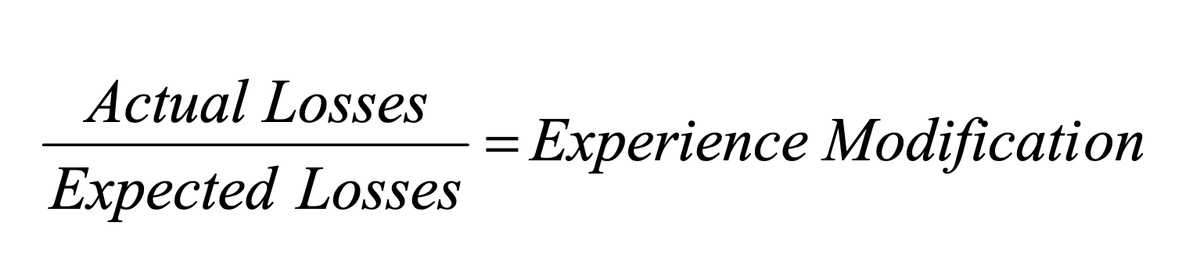

If you condense the long formula above, it will look something like this:

This number generally falls between .7 and 1.5 but can go both higher and lower depending on the size of the company and the claims profile.

Examples of how an experience modifier can affect workers compensation cost

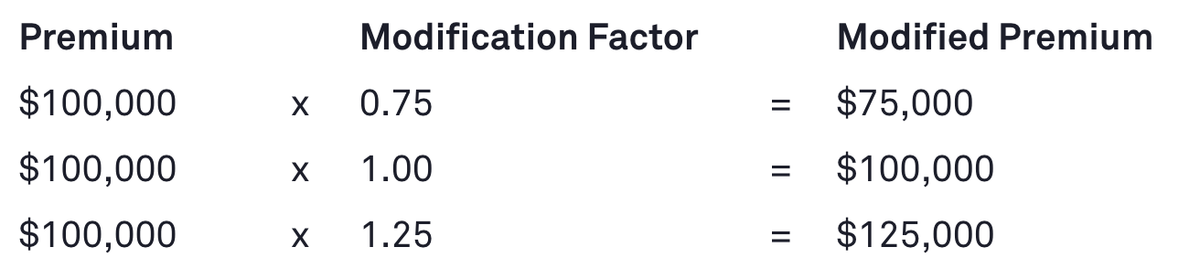

After the NCCI assigns your business an experience modifier, you can calculate how it will adjust your premium with this formula:

Total Calculated premium x Experience Modifier = Adjusted Premium

An example of how the modifier can change your workers compensation premium:

As you can see, even a minor change in your experience modifier can increase (or reduce) the workers compensation cost significantly.

Here are the basics:

Four things every employer should know about their

experience modifier

1) Claim frequency is more important than claim severity

The NCCI mentioned in their publication "ABCs of Experience Rating" that claim frequency is considered more in the modifier calculation that the severity of a claim. The reason being that "the cost of a specific accident is often left to chance and is statistically less predictable than the fact that the accident occurred"

The NCCI gives us this example:

"For example, the survivor benefits for a young worker in their 20s leaving a spouse and three children would likely be considerably greater than the survivor benefits for a worker in their 50s leaving no dependents. The important fact is that the accident did occur, so the plan gives greater weight to accident frequency than to accident severity."

Functionally, this means that small and frequent claims can negatively impact you even if the total amount of claims dollars paid out is low. This emphasis on frequency is why claims fraud is so important to many employers.

2) The experience modifier only looks at the previous three years history

If you have a high experience modifier, you aren't entirely out of luck. The experience modifier only accounts for claims occurring in the past three years. Any positive change you make can impact your modifier at a rapid rate. A good year can go a long way, and a good three years can entirely replace your old experience modifier.

3) The experience modifier is calculated six months into your "rating anniversary"

Your experience modifier calculation for the upcoming year occurs at the mid-way point into your worker's compensation insurance policy. Six months into your policy's effective date, the claim data is calculated from the large modifier formula listed above.

4) Open claims can be worse than closed claims

Open claims (claims that are still in process) are often unknown in the outcome of your experience modifier. The claim reserve is often larger than the claim will actually be. It is critical that you know your businesses open claims and follow up to get them closed.

Now that you know what the experience modifier is and the impact it can have on your business, how do you go about reducing it for your business?

Three easy ways to reduce your experience modifier

1) Choose a workers compensation carrier that prioritizes experience modifier reduction

One of the most effective ways to reduce your experience modifier is to partner with an insurance carrier that emphasizes their experience modifier management services. These carriers understand what the issues associated with a high modifier are and will help you lower it as a way to earn your business.

Although not a hard and fast rule, these carriers are often monoline carriers. Monoline means that they only write workers comp insurance, and they provide these kind of services as a way to stay competitive in the marketplace.

For a list of suggested carriers, feel free to contact us

2) Pre-screen job applicants before you hire them

There are services that you can use to screen your job applicants before you hire them. Services like IntegrityFirst screen for behaviors such as theft, substance abuse, violence, and deceit. Taking advantage of these services can help you reduce the amount of claims frequency and fraud.

3) Create a schedule to check open claims before important rating dates

Depending on the size of your business and the total number of claims that you have, there are at least two dates you should check the status of your claims.

The first is 1-2 months before the midway point in your workers compensation policy, otherwise known as the "rating anniversary date". Your modifier is calculated at the halfway point, so you should know the claims data at least a month in advance so that there are no surprises.

The 2nd most important date to know the status of your claims profile is two months before the renewal date. Minimizing your open claims is critical to negotiating favorable renewal pricing with underwriters. An open claim is a significant uncertainty that you can often avoid in these renewal negotiations.

If you have an open claim at any of these points, reach out to the claims adjuster and see if they are at a point that they can close the file. If the injured employee is already back at work and the medical bills have been paid, chances are the claim is ready to be closed.

Summary

Even though it seems complicated, it’s worth it to understand and maintain a low experience modifier. A favorable modifier can significantly lower your total cost of workers compensation insurance.

What’s Next?

Although you can find a lot success by working on your experience modifier, finding the right insurance carrier and broker will make the biggest impact on the affordability and quality of your insurance coverage. Contact us to find out how we can help find the right fit for your business.

About The Author: Austin Landes, CIC

Austin is an experienced Commercial Risk Advisor specializing in and leading LandesBlosch's design professional, real estate, and construction teams.