Directors and Officers (D&O) Insurance: An Overview

·

18 minute read

It is no secret that directors and officers (D&O) liability insurance is one of the most convoluted and misunderstood insurance policies in existence.

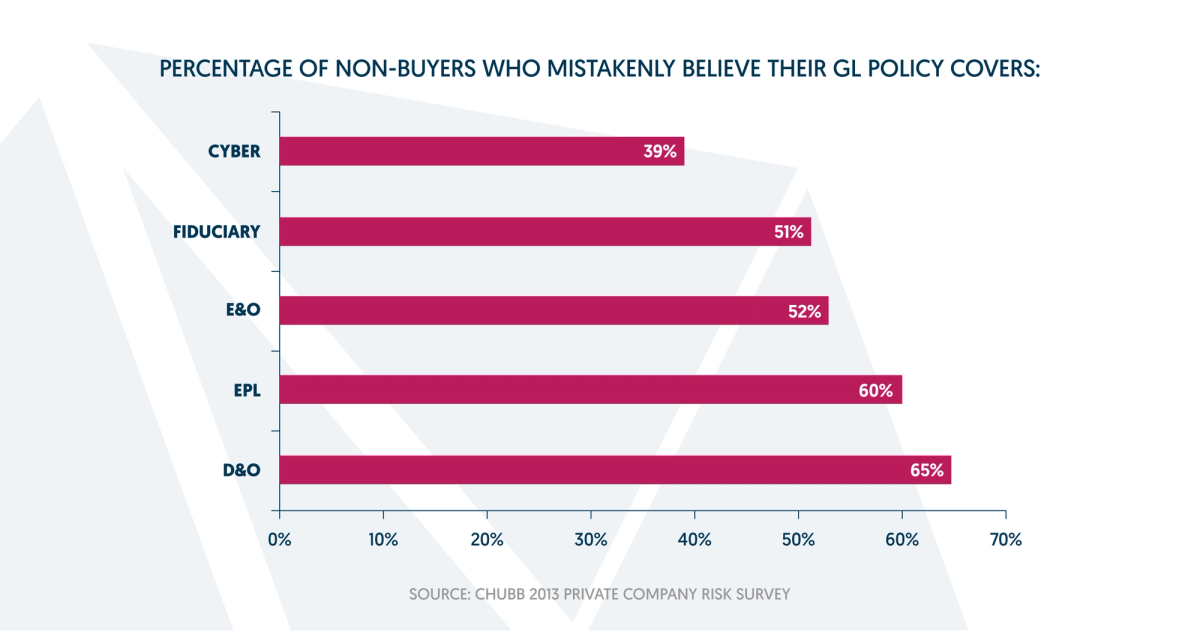

What is D&O insurance? And if someone were to ask most business executives and non-profit leaders what this insurance covered, would they be able to answer? The statistics say no: The majority of business owners don't know the difference between general liability and D&O insurance.

A 2013 survey by Chubb investigated this knowledge gap and the results show that 65% of participants did not know they needed D&O coverage.

At LandesBlosch, we think D&O insurance provides a great set of coverage that most organizations could greatly benefit from. Similar to how you purchase general liability insurance to protect your organization from liabilities, D&O insurance protects the owners, executives, and leaders from the liabilities of running a business.

Duties Of Directors And Officers

To understand the different exposures that executives have, it's important to know the responsibilities that are required of them.

There are two primary categories of executive responsibility: duty of care and duty of loyalty.

The Duty Of Care

Directors and officers are expected to perform their duties in good faith, at a level of professionalism they reasonably believe to be in the interest of the corporation and with the care that a reasonably prudent person in a similar situation would use under similar circumstances.

The Duty Of Loyalty

Directors and officers are prohibited from using their positions to further or enhance their private interests and are required to refrain from engaging in personal activities which might injure the corporation or compete against the corporation, and may not transact business with the corporation unless the director or officer can demonstrate that the transaction was fair and reasonable to the corporation.

The duties required of today's business leaders have huge ramifications and often fall in a gray area that's up to interpretation. This allows certain conditions that make corporate executives and non-profit leaders particularly vulnerable to risk. That risk isn't limited to the company they work for or own; their personal assets are at risk of being exposed to a interpretative judgment.

Protect Your Leaders From the Riskiest Exposures

Fill out the form below to get a free quote in 5 minutes.

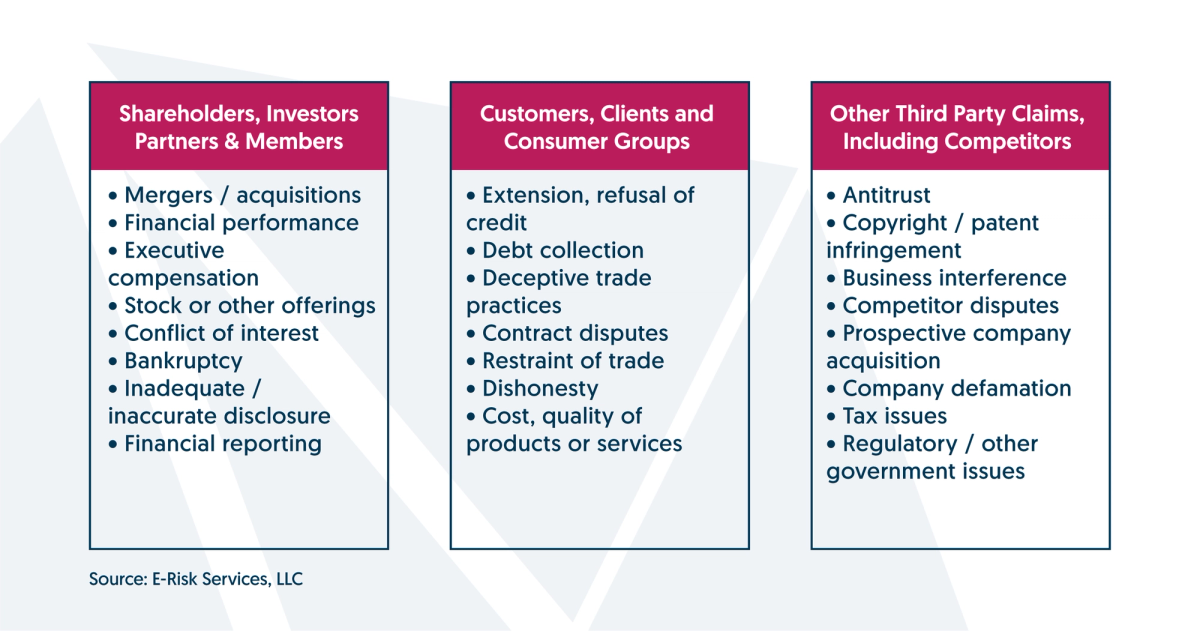

Common D&O Allegations

Now that we know what's expected of directors and officers, we can understand why they are at such extreme and unique risk. Here are some common allegations we see business leaders face:

Breach Of Fiduciary Duty

This allegation arises from a claim that the executive or board acted in their own self-interest and not in the interest of the organization they lead. Complaints often include making decisions on behalf of the company that are not in the company's best interest, but financially benefit the executive.

Wrongful Interference With A Contract

This allegation is often referred to as tortious interference with a contract. It is the claim that the business or business executive interfered with a contract they were not part of, causing a breach of contract. This claim often involves allegations of the business interfering with a party's ability to perform the contractual obligation to cause a breach of contract.

Unfair Trade Practices

An unfair trade practice claim involves an allegation that your business practices are deceitful, fraudulent, or cause harm to the customer. Frequently, these claims arise from how businesses are obtaining customers. Some examples of unfair trade practices could be misrepresentation, false advertising, unethical selling tactics, or deceptive trade practices.

Consumer Protection Violations

Consumer protection rules are state and federal laws that protect the consumer from fraud and abuse caused by businesses. In general, the Federal Trade Commission regulates and enforces these violations, but that isn't always the case.

Self-Dealing And Conflicts Of Interest

Similar to a breach of fiduciary duty, self-dealing involves prioritizing yourself or your company's financial goals over the financial goals of clients or shareholders.

This allegation generally arises from an individual benefiting from a transaction that is being executed on behalf of another party.

Violations Of State And Federal Laws

Breaking a state or federal law might cause financial harm to your shareholders and clients, whether it was intentional or not. In addition to the financial repercussions through fees and lawsuits it can cause reputational damage to the organization.

Allegations By Stakeholder

Three Real D&O Insurance Claim Examples

Fraud - $4.2 million

A government entity filed a criminal indictment against a construction company's directors and officers, alleging conspiracy and bribery. The claim alleged that the company participated in fraudulent activities, resulting in the award of a state contract. The construction company's legal defense costs alone were $4.2 million.

Breach Of Fiduciary Duty - $370,000+

An agricultural supply company had a documented business plan, including a detailed list of actions that management intended to execute in order to profit financially. A minority shareholder invested after reading the plan, but the plan was not executed due to disagreements on the management board. This resulted in lower profits than expected, and the minority shareholder sued for breach of fiduciary duty and misrepresentation. The insurer of the agricultural supply company paid more than $150,000 in defense costs before the case settled for $220,000.

Theft Of Intellectual Property - $250,000+

A joint venture between a company and a software developer failed, and the software developer sued the company's directors and officers for misappropriation of intellectual property. The software developer claimed the company used his ideas to develop its own software and create a competing product. The company's insurer paid in excess of $200,000 in defense costs and a $50,000 contribution toward settlement.

What Does D&O Insurance Cover?

Although there are many situations in which D&O insurance would be needed, organizations take out D&O insurance primarily to protect three things:

- The personal assets of a company's directors and officers;

- The company's assets;

- The company from reimbursement costs to indemnify directors and officers for their losses, as well as from defense costs associated with lawsuits and investigations.

Essentially, D&O provides personal asset and balance sheet protection for private companies, public companies, and non-profits organizations (and their leaders).

What Doesn’t D&O Insurance Cover?

Failure To Purchase Enough Insurance

Almost all D&O policies exclude lawsuits arising out of a failure to purchase adequate insurance limits. This exclusion exists to prevent organizations from underinsuring themselves with the intention of using their D&O limits to pay out any gaps or shortages in coverage.

Deliberately Fraudulent Acts Or Omissions

Although D&O insurance does cover wrongful acts, the policy will not cover a director or officer who deliberately commits fraud or breaks a law.

Claims With Prior Notice

Every D&O policy includes a prior notice exclusion, which means if you are aware of a fact, circumstance, situation, transaction, or event that could lead to a D&O claim, it is excluded from coverage.

Bodily Injury/Property Damage

D&O insurance policies always include a bodily injury and property damage exclusion. These events are covered by your commercial general liability insurance policy, so this exclusion limits any overlap between the two insurance policies.

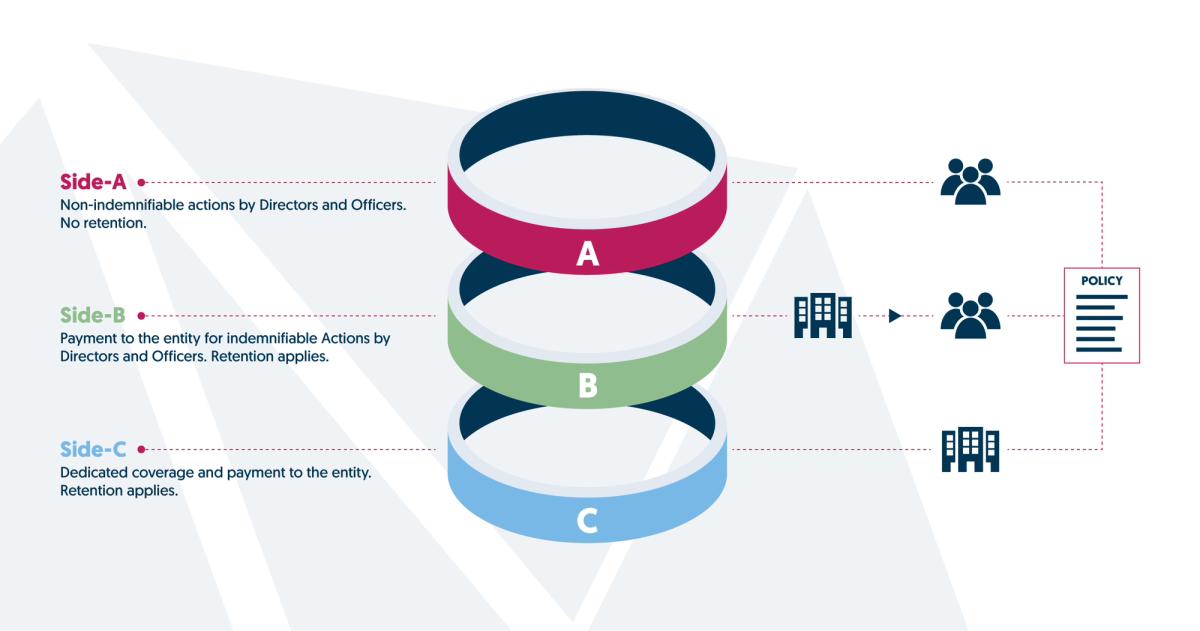

Three Core Parts Of D&O Policy Coverage

The D&O policy reads as three separate coverages wrapped into one policy: Side A, Side B, and Side C. Each side protects one of the three items listed above:

Side A - Provides financial protection when the company cannot or will not indemnify the individual directors and officers, such as per a court order.

Side B - Reimburses the company when it indemnifies individual directors and officers.

Side C - Also known as entity coverage, this responds when both individual directors and officers and the company are named as co-defendants. For public companies, this will only apply in the event of a securities lawsuit; it can apply to private companies for other causes of loss, such as employment practices, unless specifically excluded.CRC Group "State of the Market: Directors' & Officers' Liability"

Additional D&O Coverages

Antitrust Claim

Antitrust coverage in D&O insurance protects directors and officers against claims alleging violations of antitrust laws, such as price fixing, monopolization, or other anti-competitive practices. This coverage is particularly important for companies operating in highly competitive industries or those with significant market share.

While not always included in standard D&O policies, antitrust coverage can be crucial for businesses facing potential allegations of unfair competition. It typically covers legal defense costs and settlements related to antitrust claims, providing a safety net for executives who may inadvertently become involved in such disputes.

Defense Outside The Limits

Defense Outside the Limits is a valuable feature in D&O insurance policies that separates defense costs from the policy's liability limits. This means that legal expenses incurred in defending a claim do not reduce the amount available for settlements or judgments.

With this additional coverage, the full policy limit remains available to cover potential damages, regardless of how much is spent on legal defense. This can be particularly beneficial in complex, long-running cases where defense costs may be substantial. DOL provides added peace of mind to directors and officers, ensuring that their personal assets are better protected even in the face of costly litigation.

Duty To Defend vs Non-Duty

The Duty to Defend clause in a D&O policy obligates the insurer to take control of the legal defense process when a claim is made against an insured. This includes selecting legal counsel and managing the defense strategy. In contrast, a Non-Duty to Defend policy allows the insured to maintain control over their defense, including choosing their own attorneys.

Each approach has its advantages. Duty to Defend policies often provide more comprehensive coverage and can be beneficial for smaller organizations with limited resources. Non-Duty policies, on the other hand, offer more flexibility and are often preferred by larger corporations with established legal teams. The choice between these options depends on factors such as company size, risk profile, and preferred level of control in legal matters.

Shared Limits With Other Management Liability Coverages

Shared limits in D&O insurance refer to policies where the coverage limit is shared across multiple types of management liability insurance, such as Employment Practices Liability (EPL) or Fiduciary Liability. This approach can be cost-effective, as it allows for a higher overall limit at a lower premium than purchasing separate policies.

However, shared limits also come with potential drawbacks. If a significant claim is made under one type of coverage, it could deplete the available limit for other coverages. Organizations should carefully consider their risk exposure across different areas of management liability when deciding between shared and separate limits. For some businesses, the cost savings of shared limits may outweigh the potential risks, while others may prefer the added security of dedicated limits for each coverage type.

LandesBlosch D&O Recommendations

Purchase Side A DIC to gain additional executive protection.

The Side A DIC (difference in conditions) policy is supplementary coverage added to the primary D&O insurance program. This policy not only increases the limits for Side A coverage, but also provides a dedicated policy to cover board members for a variety of reasons, such as if the primary D&O policy has been exhausted or is being held as an asset in a bankrupt estate.

The Side A DIC policy will also act as the primary D&O policy if the DIC policy is broader than the primary D&O coverage (which most of the time it is).

Overall, we think it is a great idea for larger organizations to purchase this policy. For more information on Side A D&O and the supplementary Side A DIC policy, check out our article, “Side A D&O Coverage: 6 Things You Should Know.”

When switching insurance carriers, purchase a tail policy or a retroactive date.

In the current D&O market, renewals are going up in cost and businesses are looking to other carriers for better priced options. When you switch D&O insurance carriers, consider purchasing either a tail policy or a retroactive date to ensure there are no coverage gaps during the transition period.

For more information on tail policies or retroactive dates (and how to purchase both), check out our article, “Tail Insurance Coverage - What Is It?”

State Of The D&O Insurance Market

Find Out the Cost of Your D&O Insurance Options

Tell us some basic information and get a free, instant quote.

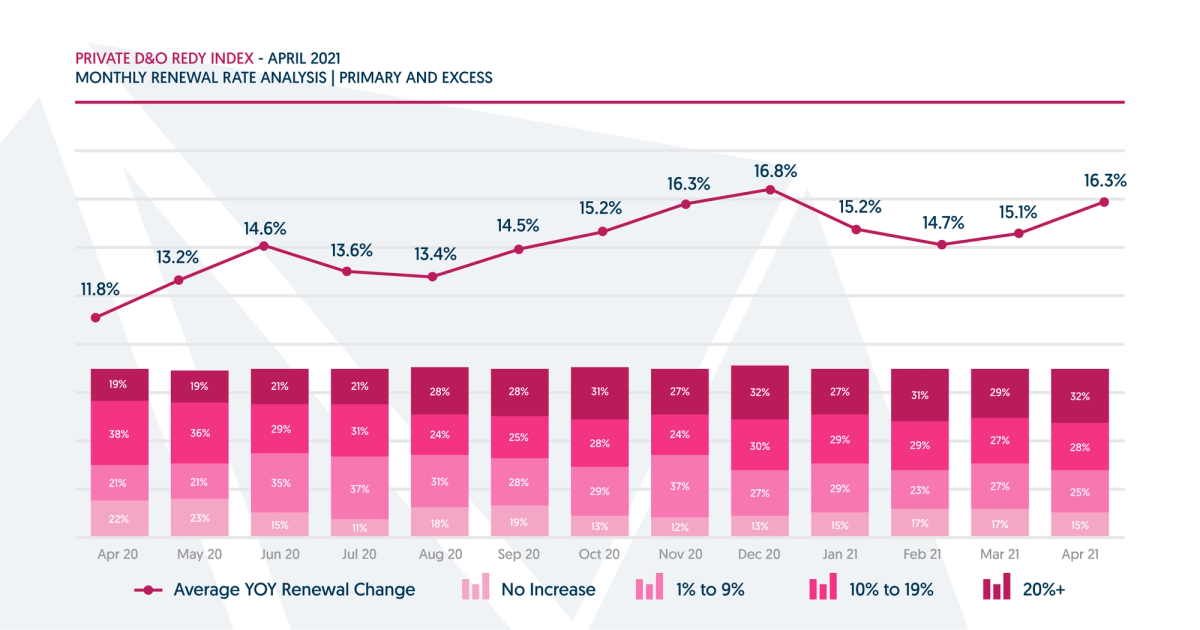

In general, D&O policy rates are going up and the COVID-19 pandemic has pushed markets to implement stricter underwriting requirements. Insurers remain aggressive for select industry types, but are showing a lack of interest for others, such as healthcare.

Here’s what you can expect to see on your upcoming D&O policy renewal:

- Increased financial scrutiny from underwriters.

- Questions regarding how you handled the COVID-19 pandemic and will continue to be affected by it.

- Continued rate increases of at least 10%

According to CRC Group, insurers are on average seeking a 11.8% to 16.8% increase on D&O renewals and very few policies are renewing with no increases. Additionally on the renewals, we are seeing underwriters take a deeper dive into accounts than they have in the past.

Your D&O Insurance Options

D&O insurance for your board is unique and therefore requires a unique policy. At LandesBlosch our goal is to partner you with an insurance carrier that understands what you are doing and knows how to protect your work and mission.

Although many carriers can provide D&O insurance quotes, here are some we recommend for your company or nonprofit.

Philadelphia

Philadelphia is a leading insurer of D&O insurance coverage. They have a very broad appetite across industry segments that include nonprofit, private, and public companies. They have an A.M. Best rating of A++ (Superior) with a stable outlook.

Brotherhood Mutual

Brotherhood Mutual is a specialty insurance carrier that focuses on churches and related ministries. They are a mutual company, which means they are owned by the ministries they insure. They have an A.M. Best rating of A- (Excellent) with a stable outlook. Brotherhood is the premier choice for ministry, church, and university insurance countrywide.

Chubb

Chubb is a general insurance carrier that focuses on specialty lines within the nonprofit, publically traded, and private company sector. They underwrite coverages such as D&O, EPLI, Crime, and others. They have a A.M. Best rating of A++ (Superior) with a stable outlook.

Berkley Management Protection

Berkley Management Protection is a specialty insurance carrier that underwrites a management liability coverages only. Their management liability offering covers D&O, EPLI, Crime, and fiduciary liability for nonprofits, publicly traded, and private companies. They have an A.M. Best rating of A+.

Summary: Why Should You Get D&O Insurance?

- Individual directors' and officers' personal assets will be on the line without coverage.

- Companies will have a difficult time attracting qualified individuals to their boards without D&O coverage.

- The high cost of defending corporate lawsuits may exceed the net worth of most private companies.

- Judgments can be financially crippling.

- Bad business decisions are likely to attract the attention of shareholders, regulators, and others.

- Directors and officers work in demanding environments and have substantial corporate duties that put them at risk.

Although not every company should purchase directors and officers liability insurance, a lot do. If you and your business are exposed to any of these risks, chances are you might have a large coverage gap - and that coverage gap could affect your personal finances.

About The Author: Austin Landes, CIC

Austin is an experienced Commercial Risk Advisor specializing in and leading LandesBlosch's design professional, real estate, and construction teams.