The General Aggregate Limit - What Is It?

·

13 minute read

What is a general aggregate, and what does it mean for your business?

The general aggregate is the maximum amount of money a liability insurance policy will pay in a given policy term.

Unlike a per-occurrence limit, which limits the amount per claim, a general aggregate limit can be exhausted through either two claims, fifty claims, or anywhere in between.

We know that general aggregates can be confusing, especially for certain niche insurance policies or insurance requirements that you might face. That’s why we’ve put together this guide to general aggregate limits.

How does the general aggregate work?

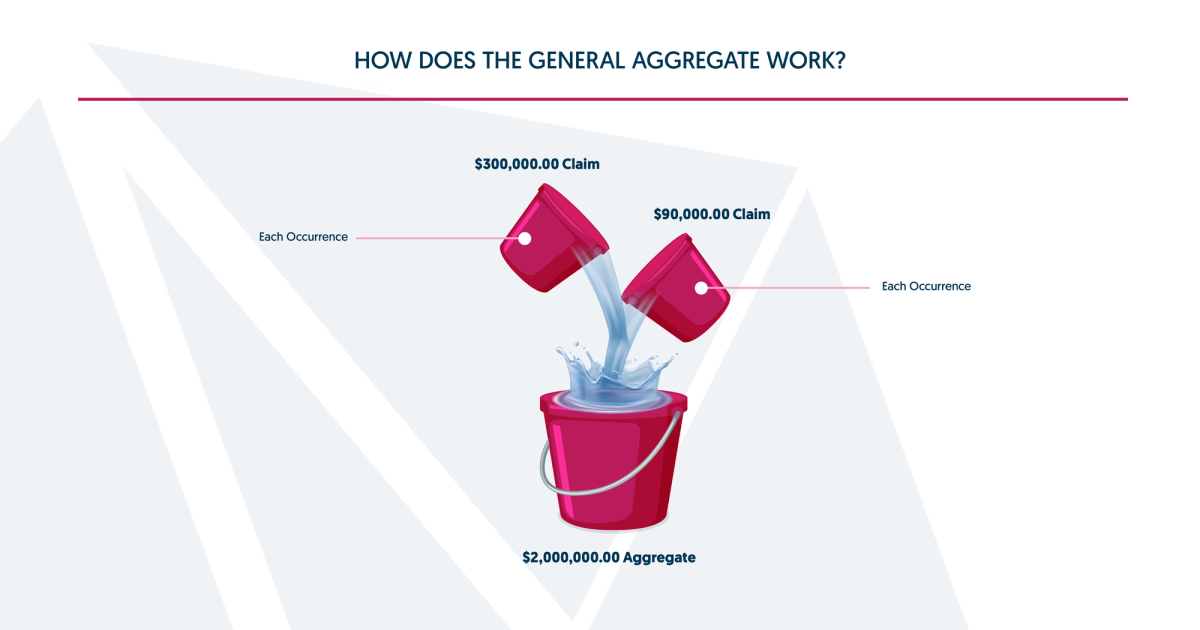

Take a look at the illustration below. Let’s assume you have the traditional general liability insurance policy of $1 million per occurrence and a $2 million general aggregate.

IImagine that each smaller bucket is each claim (or an "occurrence," as your policy states). Each of the smaller "per occurrence" buckets can fit $1 million worth of liability in a single claim.

The big bucket represents your general aggregate limit, which is the maximum the insurance company will pay, regardless of claim quantity. The big bucket can fit up to $2 million worth of liability, regardless of the number of claims.

As a liability claim happens, it will begin to fill up a small bucket. Once the small bucket is filled, it will get dumped into the larger bucket (the aggregate bucket).

This way, no single "per occurrence" bucket can completely fill up the aggregate bucket. You would need a minimum of two full occurrence buckets!

What is a per-project aggregate?

This is a common requirement for certain types of businesses, usually in the construction industry. In fact, it’s so common that we thought we needed to mention it in this post.

As explained above, the general aggregate gets eroded every time you file a claim. If you have a lot of claims, you may run out of insurance limits.

Since construction projects can be prone to claims and damages, certain construction jobs require that you have a dedicated aggregate limit set aside for that job.

This ensures that even if you max out your policy with claims and the project owner needs to file a claim against your insurance, they have their own dedicated limits to collect against.

Since you’re essentially buying additional limits, this endorsement will usually result in an additional premium.

Why is the general aggregate important for your business?

The general aggregate is very important to your business, because it means that one claim won’t wipe out your entire insurance policy. If you have a worst-case scenario claim, you will still have insurance after that claim occurs.

Additionally, it makes insurance more affordable because you and the insurance company will agree on the maximum amount that insurance policy will pay out. After all, you can always purchase a higher limit.

Worried about the rising costs of insurance?

Our policies are customized to your business, so you only pay for what you need. Get an instant quote or schedule a quick call to learn more.

Why are aggregate limits necessary in the insurance industry?

The general aggregate limit reflects the industry’s response to the dynamic and often challenging landscape of liability and risk. Here’s why it’s necessary for the healthy functioning of the insurance industry.

Risk Management

If insurers had to assume unlimited amounts of liability, policies would become very expensive. The general aggregate limit helps them remain solvent, which means they’re able to pay debts – like insurance claims.

Caps also help insurers better predict potential losses, so they can price policies accurately and stay financially stable.

Legal and Regulatory Environment

As legal liabilities expand, the risk of being sued increases for businesses. The general aggregate limit helps insurers continue to offer coverage without taking on unmanageable risk.

Insurance companies are also required to have a certain amount of cash on hand to pay out claims. By capping their liability exposure, they can ensure compliance with regulatory requirements.

Market Conditions

The aggregate limit was introduced as part of a broader movement towards creating more comprehensive products to cater to the needs of diverse businesses. It also allowed insurers to offer competitive pricing that made liability insurance more accessible for many businesses.

Claims Frequency and Severity

With the increase in both litigation and the size of settlements and judgments, today’s insurers face more claims than they did in the past, and for larger amounts. The general aggregate limit ensures they remain financially stable, even in the face of rising claims.

Clarity and Standardization

Over time, the insurance industry has become more standardized and providing a general aggregate limit is now commonplace. This provides consistency for policyholders and helps clarify terms by outlining exactly how much the insurer will pay during the policy period.

What insurance policies do not have an aggregate limit?

Not every insurance policy has an aggregate limit. If a policy is required by the government, for example, it likely doesn’t have an aggregate limit. Here are some of the policies in this category.

Auto Insurance

Auto liability insurance isn’t subject to aggregate limits like a general liability policy. Since everyone who drives is required by law to have auto insurance, it doesn’t make sense to have a general aggregate limit. You’d have drivers on the road who are ostensibly insured but who have exhausted their policy!

Workers Compensation

If you’re an employer, chances are you’re required by state law to carry workers compensation insurance to pay for employee injuries that happen while they’re on the job.

It’s an employee's right to a reasonably safe working environment and to have their medical bills paid if they’re injured on the job.

It’s not their fault if their employer has had some bad claims that year – by law, they’re entitled to compensation. That means the insurance company must cover what is owed, and can’t cap the policy.

Excess Liability And The General Aggregate

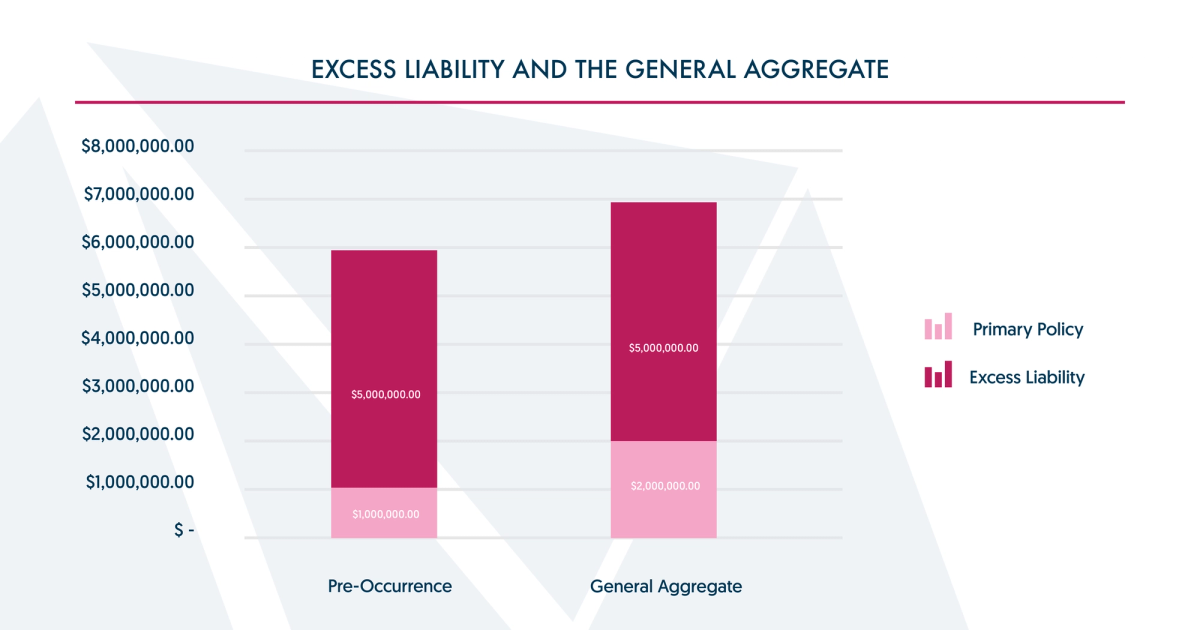

Even if a policy has an aggregate limit, there is a way to increase the maximum amount of money the insurance company must pay out. With an excess liability policy, you can increase not only your "per occurrence" limit, but also your general aggregate limit. Here’s how it works:

As you can see, the excess policy sits on top of both the occurrence and the aggregate limit to increase both. A $5 million excess liability policy results in $6 million for any one occurrence and $7 million aggregate.

Examples of General Aggregate Limits In The Real World

The general aggregate limit can come up in a variety of situations. Let’s look at a few common examples to make the definition more clear.

Multiple Types of Claims

A construction firm has both general liability and workers compensation policies, each capped at $1 million, and a $2 million umbrella policy for additional coverage.

General Liability Claims: An accident leads to a $1.2 million claim. The first policy covers $1 million, and the umbrella covers the extra $200,000. A subsequent accident costs $800,000, covered by the general liability policy.

Workers Compensation Claim: A major accident results in a $2 million employers claim. The first policy pays $1 million, and the umbrella policy covers the remaining amount.

Outcome: Due to the general liability aggregate limit of $2 million, only $1.2 million of the umbrella policy limit was used ($200,000 for general liability claim and $1 million for workers compensation). The second $800,000 general liability claim was covered by the general liability aggregate limit. This example shows why it’s so important to have an aggregate to allow for multiple claims.

Series of Construction Claims

A general contractor hires an uninsured plumber for a housing project. Over time, plumbing issues arise, leading to water damage in multiple houses in the development.

Initial Claims: Damage claims total $4 million through multiple occurrences. The contractor's general liability policy covers $2 million in the aggregate which exceeds their general liability policy limit.

Excess Liability Policy: The next $2 million in claims are covered by an excess liability policy. The total excess policy has a per occurrence and aggregate limit of $5 million, leaving a balance of $3 million for the remained of the policy term.

Outcome: The situation stresses the importance of requiring subcontractor insurance and understanding the value of excess liability policies. The contractor would not be out any extra money besides any deductibles they had in the policy.

Product Liability Claim

A technology company turns to its product liability insurance after it releases a new appliance with a dangerous design flaw that causes injuries.

Initial Lawsuits: The first personal injury lawsuit amount to $1.2 million. The company's general liability policy covers $1 million, leaving $200,000 to the excess policy. The company reaches its policy aggregate limit as more lawsuits come in, surpassing the $2 million cap.

Excess Liability Policy: The next $800,000 in claims are covered by a $2 million excess liability policy. Additional lawsuits use up the remaining excess liability policy balance.

Outcome: The aggregate limits helped the company gain additional liability limits when multiple claims were involved. Additionally, the excess liability aggregate stepped in to pay any additional costs that exceeded the primary per occurrence limit. Any company at risk of product flaws needs to make sure it has sufficient insurance coverage.

Common Issues With The General Aggregate

Non-Concurrent Effective Dates

You may face problems if you purchase additional limits of liability on an excess insurance policy and the underlying policies don't all have the same policy effective dates.

You could have a situation where the general aggregate is reinstated on the primary liability policy but not on the umbrella, or vice-versa.

Having non-concurrent effective dates isn't always a problem, but make sure you discuss it with your insurance broker.

Insurance Requirements

Some contracts require uncommon aggregate limits. For example, the majority of insurance policies are $1 million per occurrence and $2 million general aggregate.

A contract that requires $2 million per occurrence and $5 million general aggregate is awkward, since a $1 million excess liability policy would only meet the occurrence requirement, but a $3 million excess liability policy might feel like you are purchasing too much insurance.

If this sounds like you, it’s time to have a discussion with your insurance broker! Underwriters can get creative in these situations. They may offer increased aggregate limits on the primary liability policy so you don't have to purchase a full $3 million excess.

Too Many Additional Insureds

Companies are quick to hand out the “additional insured” endorsement on their insurance policy to win jobs and get business. The problem: now your insurance policy isn’t just providing indemnification for you, it’s insuring 200 other businesses, too.

This could create a situation where you need much higher limits so there’s enough money to cover all the parties your insurance company is defending.

The Bottom Line

The general aggregate limit plays a critical role in how liability insurance policies function. It was introduced as a risk management tool to help insurers maintain financial stability and offer competitive products, while also providing clear and standardized terms for policyholders.

If you need additional limits, you can take steps like purchasing an excess liability insurance policy or even getting a project aggregate limit.

Regardless, if you’re looking to help to review your aggregate limits or need assistance meeting certain insurance requirements, let us know!

About The Author: Austin Landes, CIC

Austin is an experienced Commercial Risk Advisor specializing in and leading LandesBlosch's design professional, real estate, and construction teams.