Technology E&O Insurance: What Is It?

·

9 minute read

Technology Errors & Omissions (Tech E&O) is an insurance policy that protects you from liability when mistakes in your technology products or services cause financial harm to the customer, user, or others.

Need A Tech E&O Insurance Quote?

We are here to help! Schedule a call or start an online quote today.

Unlike many forms of commercial insurance, there is no concrete standard for this coverage; this policy can differ widely among each insurance company.

That being said, each company generally aims to cover the same incidents and that is what we cover in this article. This information is a reference to what will probably be included in your policy, but you should not expect your policy to duplicate it .

In this blog, we will review the following four parts of the technology E&O policy:

- Tech & Professional Services Wrongful Act

- Tech Product Wrongful Act

- Media Wrongful Act

- Data & Network Wrongful Act

These four parts work in conjunction to form a comprehensive tech errors and omissions insurance policy that protects companies from their associated risks.

What types of companies need Technology E&O insurance?

Any company with a technology-based exposure that isn't covered by either a commercial general liability policy or a standard errors and omissions policy needs technology errors and omissions insurance.

The commercial general liability policy covers property damage and bodily injury arising out of your operations. This is a policy you should have, but it doesn't fully cover the threat of when your technology fails and financially harms a customer.

Additionally, a traditional errors and omissions policy is aimed at professional services and doesn't encompass the full scope of developing or offering technology services and products. For example, the insuring agreement for many of these traditional E&O policies states that coverage is applicable if it happened "as a result of your rendering of professional services."

Although this could cover some aspects of a technology-based business, it’s not the best fit. We view companies that are developing applications and software more akin to manufacturing than consulting, since they are building and selling a product. The technology errors and omissions insurance policy addresses these flaws in the traditional E&O policies, using wording that covers your unique risks as a technology company.

Your business should consider purchasing Tech E&O coverage if you:

- Develop software or do any coding

- Manufacture technology products

- Perform technology installation or setup

- Consult about technology products

Technology Errors & Omissions Coverages

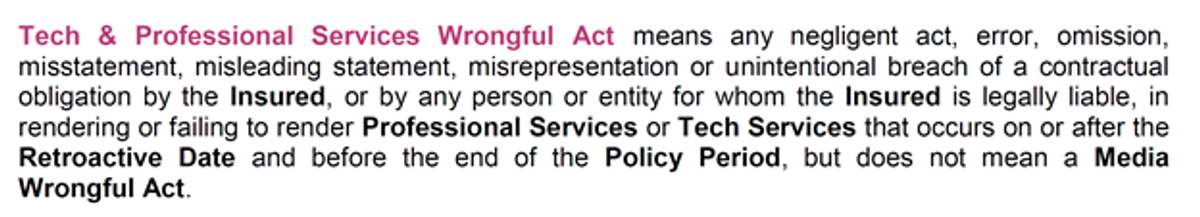

Tech & Professional Services Wrongful Act

Here is an example of this coverage part:

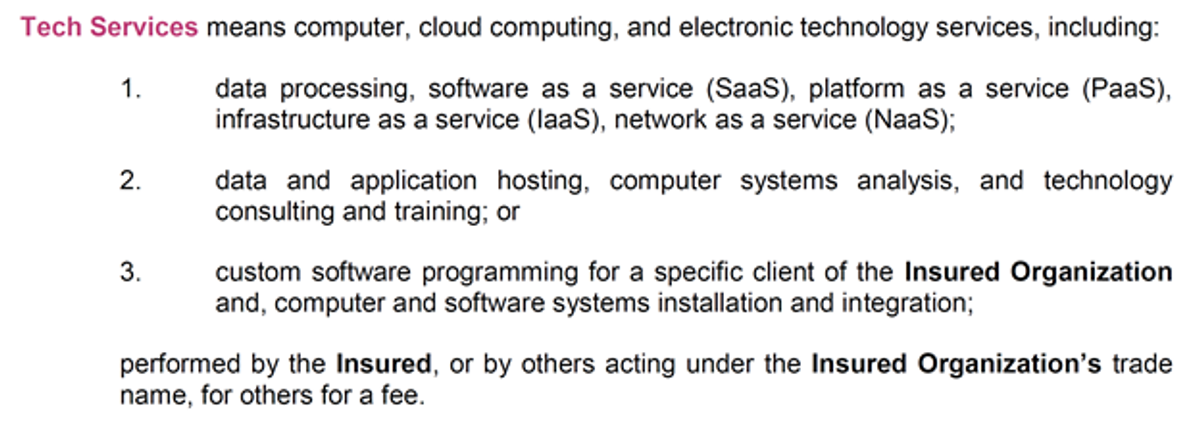

And the definition of "tech services" is:

This coverage provides defense and pays up to the limit of liability for mistakes that you make while providing technology services to customers. This could include errors in your work, breach of contract, misrepresentations, and more.

Note that this element of Tech E&O coverage closely aligns with a traditional E&O policy in that it provides coverage for mistakes in your services, but the phrasing and definitions are tailored to refer to technology companies.

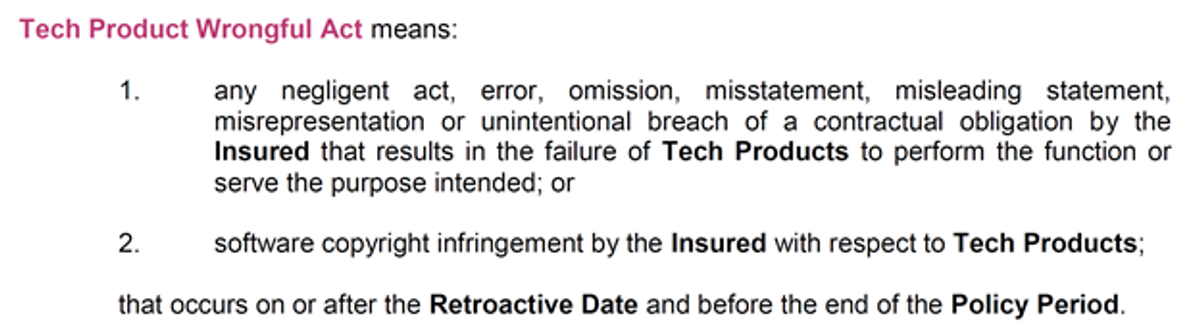

Tech Product Wrongful Act

Here is an example of this coverage part:

This covers liability arising out of your tech products failing to perform.

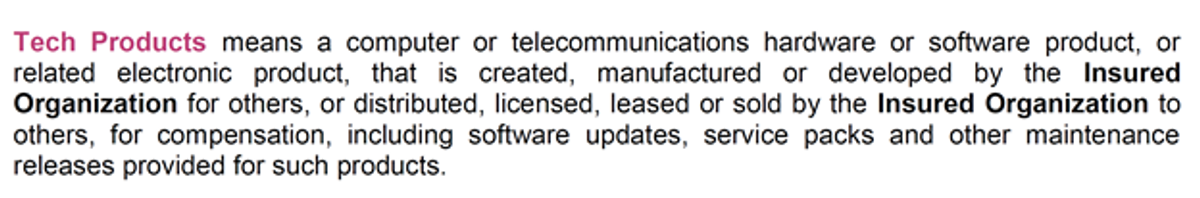

And the definition for “tech products” is:

Whereas the previous coverage part provides protection from mistakes in the technology services you provide, this coverage part protects from a failure in the technology products you sell.

Media Wrongful Act

The media wrongful act coverage isn't specific to the technology errors and omissions policy; it is standard on many cyber liability insurance and traditional E&O policies.

Also, the commercial general liability policy includes some language in the personal & advertising liability section that covers defamation-related claims. But it only provides coverage in limited scenarios, such as in the use of advertisements.

Media coverage, when added to a cyber or E&O policy, usually extends protections beyond advertisements and includes mediums such as social media and blogs.

For example, if you make a post on social media about how your product is superior to a competitor, and that competitor views that post as defamatory, the technology e&o policy could cover an incident like this (assuming social media is a covered publication on the policy).

Data & Network Wrongful Act

This part of the technology E&O policy is similar to the cyber liability insurance policy. It covers data breaches, security breaches, and privacy violations that took place on your systems or any third-party systems you are liable for.

What Technology E&O Does Not Cover

Infrastructure Failure

Most tech E&O policies will not cover infrastructure failure. For example, suppose a claim arises out of a failure of satellites, power, utilities, mechanical, or telecommunications (including internet) infrastructure that’s not in the insureds direct operational control. In that case, the claim would be excluded under most errors and omissions policies.

Prior Known Acts

If you were made aware of a situation before the purchase of and effective date of the policy, it is excluded. As with all insurance, you cannot purchase insurance after the incident and expect it to be covered under the policy.

Pollution Liability

Although some specialized technology errors and omissions policies can cover pollution liability, the vast majority do not.

For most policies, pollution is explicitly excluded in almost all instances. If the failure of your technology products or services could lead to a pollution incident, make sure your insurance broker is aware of this risk and can find a policy without the pollution exclusion.

LandesBlosch Recommendation: Technology E&O insurance is a very customizable policy. Often written through E&S insurance companies, unique requests (such as adding pollution coverage) are frequently accommodated. If you need a certain risk covered, talk to your broker about it. Chances are, you can find a policy to address your risks.

Technology Errors & Omissions Claims Examples

Managed IT Service Provider

A managed IT service provider is hired to set up, configure, and manage the infrastructure of a company for a monthly fee. The provider’s services range from basic help desk to network security and antivirus implementation.

The company experiences a cyber-attack and client files are released to the public. Upon further investigation, the cyber intrusion began on a computer that the IT service provider failed to secure.

A technology errors & omissions policy would cover this professional oversight.

Website Developer

A company offers website development and design services to customers who need to collect payments and sensitive information on their sites. Services are provided to customers in exchange for a fixed monthly fee.

Due to a security flaw in WordPress and the company's failure to update to the latest firmware version, all of the developer's clients were targeted in a cyber-attack that involved injecting malware on customer websites and collecting unencrypted information from all form submissions.

A technology errors & omissions policy would cover the web developer's liability in this cyber-attack.

SaaS Data Breach

A software vendor in the real estate industry helps investors and property managers keep track of tenants, run background checks, check credit scores, and collect rent payments.

The software vendor experiences a data breach, which could potentially have resulted in its entire database getting leaked into the public, including tenant information.

The technology errors & omissions policy would pay for the data breach investigation and the liabilities resulting from the data breach.

Summary

As our world becomes more digital, the technology threats are greater. The increasing reliance on and sophistication of technology makes companies more vulnerable to cyber-attacks, as well as more at risk for liability if that technology fails. There’s a clear need for an insurance policy to absorb the risks associated with offering technology products and services.

About The Author: Austin Landes, CIC

Austin is an experienced Commercial Risk Advisor specializing in and leading LandesBlosch's design professional, real estate, and construction teams.