Insurance For Business Consultants: What To Know

·

5 minute read

Even if your work does not involve heavy equipment or hazardous job sites, consulting still carries real risk. A misstep in your advice, a missed requirement in a deliverable, or a client data incident can trigger costly disputes. The good news: a tight, consultant focused insurance package is straightforward and affordable when you know what to buy and what to avoid.

This guide explains the coverages business consultants actually need, shows real world pricing benchmarks, and includes a downloadable checklist you can hand to any agent so you are fully protected without overpaying.

Why Consultants Need Insurance

Contract and procurement requirements.

Many clients require a certificate of insurance and specific endorsements before you can start work.

Advice and deliverables exposure is your primary risk.

If a client alleges your recommendations or work product caused a financial loss such as missed milestones, faulty analysis, or project overruns, you will want defense counsel and coverage in place.

Data and privacy risk.

Consultants routinely handle client PII, financials, credentials, and strategic documents. Business email compromise, ransomware, and vendor breaches can all drag you into costly notification and remediation.

Third party injury and property damage is low but not zero.

You may visit client offices, host workshops, or attend events. General Liability still matters and it is often required, even if the probability of a large physical world claim is small.

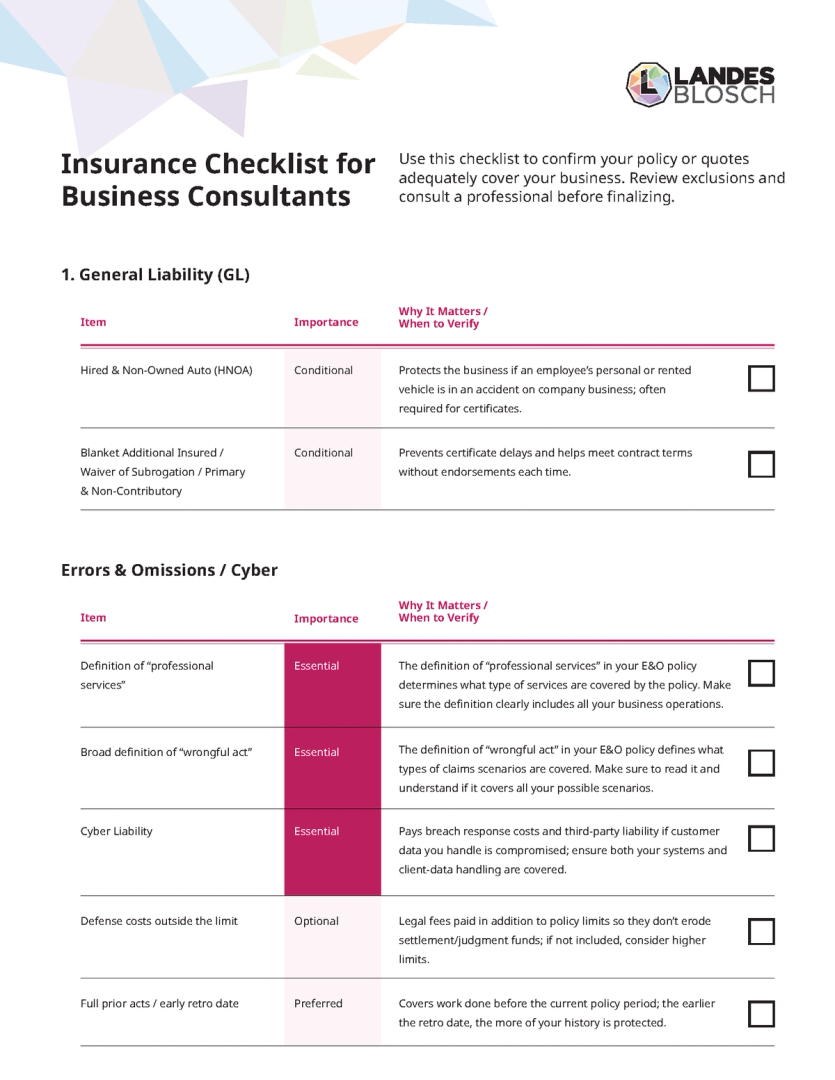

Download: Business Consultant Insurance Checklist

Download our business consultant insurance coverage checklist to help you get the best deal on your insurance.

The Insurance You Actually Need

1) Errors and Omissions is your core policy

- What it covers: Allegations that your advice or deliverables caused a client financial loss. Includes defense costs which are often the biggest expense.

- What to look for: Broad definition of professional services, duty to defend, coverage for subcontractors or 1099s.

2) Cyber Liability and Data Breach

- What it covers:

- First party: Incident response, forensics, notification and credit monitoring, data restoration, ransomware or extortion, business interruption.

- Third party: Claims from clients or regulators after a breach.

- Key enhancements: Social engineering and funds transfer fraud, dependent business interruption for cloud and SaaS outages, PCI compliance coverage if you touch payments.

3) General Liability

- What it covers: Third party bodily injury and property damage. Think of a client trip and fall in your office or accidental damage to a client location.

- Why carry it: Contract compliance and incidental premises or operations risk.

My Method (How To Build Your Program)

- Secure the E&O quote first: It addresses your largest exposure which is advice and deliverables. Start here and get the broadest form at a fair price.

- Add General Liability and Cyber from the same carrier when possible: One carrier equals one claim report and they sort out which policy responds. Multi policy claims are common and can otherwise become finger pointing contests.

- Protect your retro date: When switching carriers, confirm prior acts are included and the retroactive date carries forward.

Coverage Traps To Avoid

- Narrow named services on E&O. If your scope evolves, you do not want a policy that only covers a short list of activities.

- Retroactive date reset or no prior acts. This is a common way a cheap quote becomes very expensive at claim time.

- Subcontractor exclusions. Many consultants scale with 1099s. Make sure your policy still responds.

- Cyber gaps:

- No social engineering or funds transfer coverage which is a common attack vector.

- No dependent business interruption for critical vendors such as cloud or SaaS providers.

- High waiting periods before business interruption triggers.

Real World Pricing Examples

Below are actual examples from a quality carrier for a consulting firm at three revenue levels purchasing General Liability, E and O, and Cyber. Pricing varies by state, prior losses, limits and deductibles, data sensitivity, contracts, and controls. These are useful benchmarks.

| Annual Revenue | GL | E&O | Cyber | Annual Cost | Monthly Cost |

|---|---|---|---|---|---|

| $250,000 | $250 | $742 | $470 | $1,462 | $122 |

| $1,000,000 | $260 | $1,411 | $1,544 | $3,215 | $268 |

| $5,000,000 | $352 | $2,963 | $2,314 | $5,629 | $469 |

Best Insurance Providers for Business Consultants

Whether you’re a solo advisor or running a small team, you’ll want a carrier lineup that does E&O (professional liability) really well and can bundle Cyber and General Liability when it makes sense. Below are options we often use for consulting firms.

| Provider | Why it’s a good fit for consultants | How to get it |

|---|---|---|

| LandesBlosch | Independent broker with deep experience insuring consultant E&O, Cyber, and GL. | → Request a quote and we’ll shop multiple carriers for you. |

| The Hartford | Offers Professional Liability (E&O) for service businesses; works well for small to midsize consulting firms and can package with GL on a single policy. | Contact via LandesBlosch for a custom quote. |

| Chubb | Robust Miscellaneous Professional Liability policy with extensive options to customize the coverages. A premium insurance carrier for consultants. | Contact via LandesBlosch for a custom quote. |

The Bottom Line

Consulting risk is not about ladders and forklifts. It is about advice, deliverables, and data. Lead with a strong E and O policy, pair it with Cyber, and round it out with General Liability plus other coverages as your contracts and operations require. The premium difference between airtight coverage and a paper thin policy is usually small until a claim hits.

Business Consultant FAQ

About The Author: Austin Landes, CIC

Austin is an experienced Commercial Risk Advisor specializing in and leading LandesBlosch's design professional, real estate, and construction teams.