Do 1099 Employees Need Workers Compensation?

·

14 minute read

Understanding workers compensation as it relates to 1099 independent contractors can be tricky. On one hand, workers compensation is meant to provide workplace protections to employees. Individual 1099 contractors are not employees, so these protections technically do not extend to them.

But on the other hand, many businesses are trying to designate their employees as 1099 independent contractors to avoid certain costs and liabilities, even though they still have a traditional "employer/employee relationship."

That raises two important questions:

- Does an employer have any responsibility to provide workers compensation to a 1099 contractor?

- Does a 1099 contractor need to provide workers compensation to themselves. even though they don’t have employees?

The answer to both questions is yes, and we’ll explain why. Let’s begin here:

Why do independent contractors need their own workers compensation insurance?

There are two primary reasons why companies often require independent contractors to carry their own workers compensation coverage, regardless of any state laws.

1. The company is often responsible for paying workers compensation claims, regardless of whether the worker has 1099 status. (There is more riskfor the employer.)

Suppose an independent contractor was injured while working for a company. In many situations (depending on the state), the company is responsible for paying the claim through their workers compensation policy.

For example, here is the Oklahoma Workers Compensation Statute on the matter:

85A OK Stat § 85A-36 (2020) If a subcontractor fails to secure compensation required by the Administrative Workers' Compensation Act, the prime contractor shall be liable for compensation to the employees of the subcontractor unless there is an intermediate subcontractor who has workers' compensation coverage.

In other words, there is no benefit to the employing company from having an uninsured independent contractor, only additional risk.

Requiring independent contractors to carry their own workers compensation coverage takes employers off the hook for paying any claims because the responsibility now rests with the insurance company.

2. The company has to pay for workers compensation on all uninsured 1099 contractors. (It's cheaper and less hassle to have contractors purchase their own insurance.)

Annual workers compensation audits require that any company with workers compensation insurance has to disclose its payroll for both employees and uninsured subcontractors (including independent contractors).

If a company hires an independent contractor and does not provide a certificate of insurance, the cost of that contractor is added to the workers compensation payroll, increasing the price of the company’s own policy.

What does workers compensation insurance cover?

When your insurance company receives a valid workers comp claim, whether it’s for a 1099 contractor or an employee, your policy will provide essential coverage for things that can get very expensive, very quickly. More specifically, workers compensation benefits cover medical costs and lost wages for an employee who unable to perform their role due to a workplace injury or occupational disease. This includes:

- Medical treatments (all medical care, from prescriptions and surgery to physical therapy)

- Temporary or permanent disability

- Death (benefits paid to employee’s dependents)

- Disfigurement

- Rehabilitation

- Out-of-pocket expenses related to the injury

Most workers compensation policies include an “exclusive remedy provision,” which means an employee cannot sue their employer for an injury once they accept workers comp benefits. But if you are in a situation where you need legal representation, workers compensation insurance also typically includes liability insurance, which covers legal fees.

In short, without this coverage, you could be financially liable for costs that can quickly skyrocket and threaten the financial stability of your company.

Advice For 1099 Independent Contractors

Legally, you only need workers compensation coverage if your employer requires it.

In most states, you are not legally required to purchase workers compensation insurance if you have zero employees. That being said, it all comes down to whether the companies you contract with require that you have this type of coverage.

If they do require it, you can always ask them if it can be waived. But often this is a no-exceptions policy for many companies because it can lead to the higher costs and risks stated above.

If you bring on additional help, remember that you are now the employer.

Especially in the construction industry, we often see independent contractors or subcontractors take on a project that requires hiring additional workers. If you ever find yourself in this situation, make sure you understand what you need to do from an employer’s perspective, and not just the 1099 contractor's perspective.

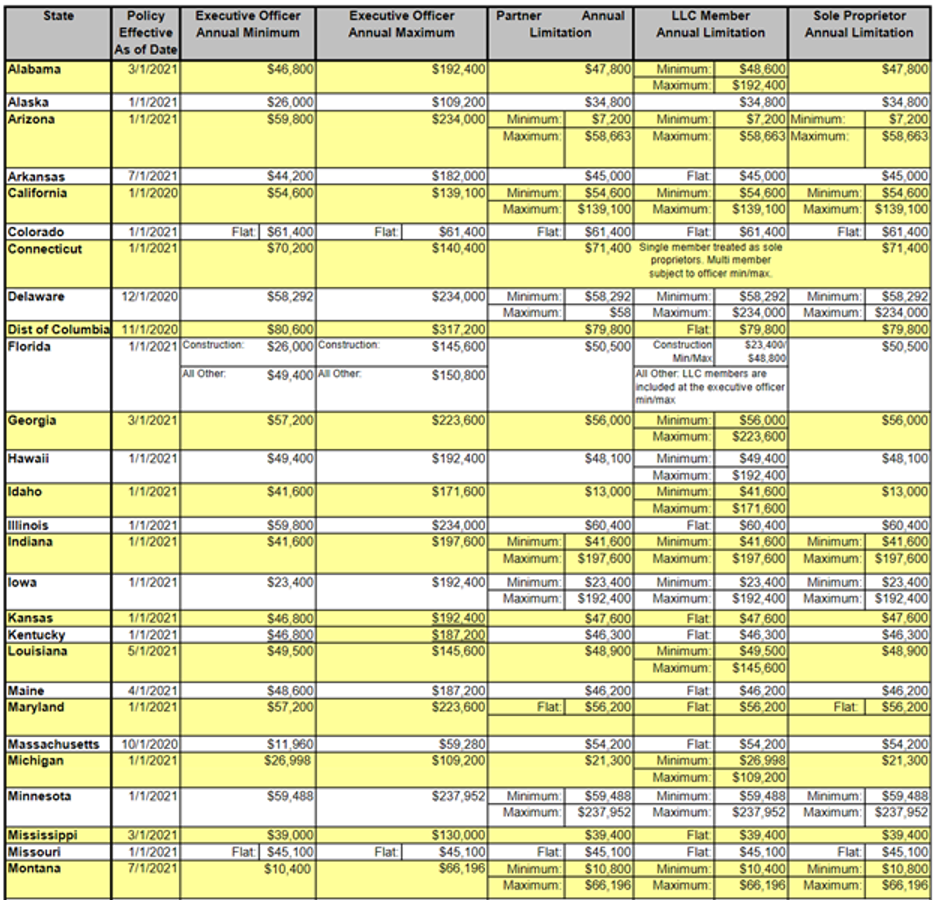

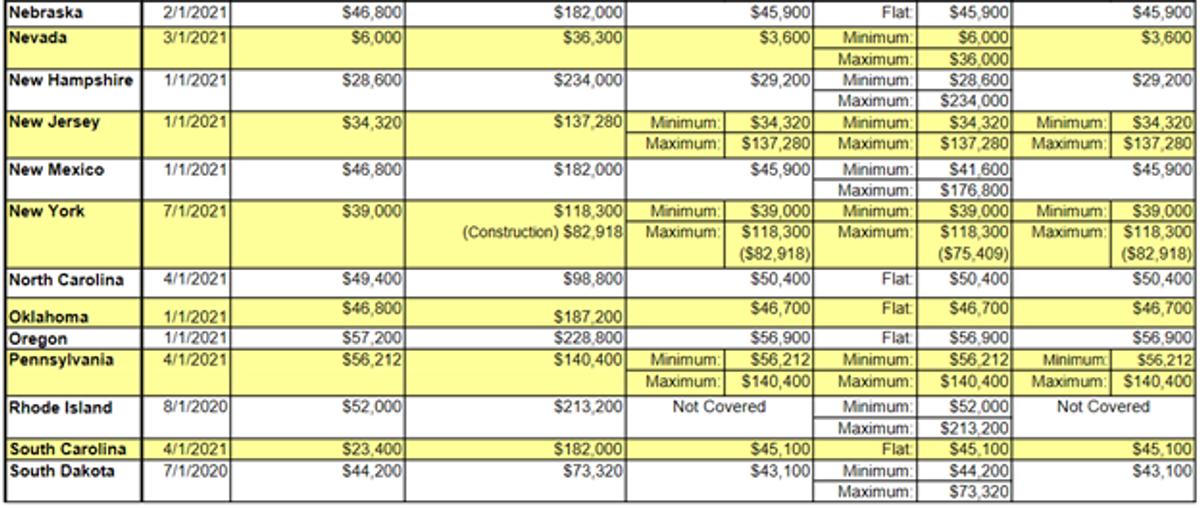

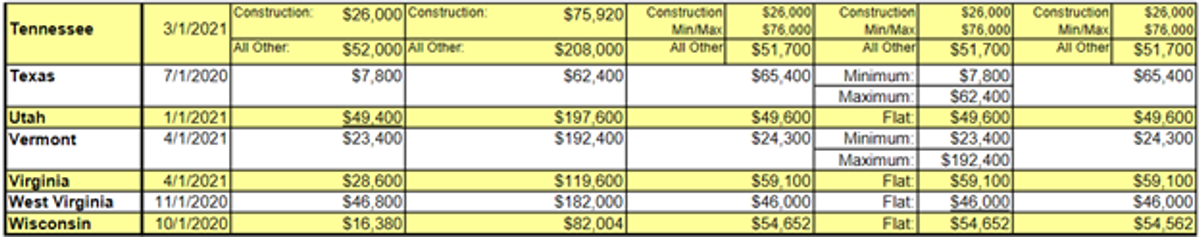

LandesBlosch Recommendation: If you do need to purchase a workers compensation policy, learn your state’s owner payroll caps to save money.

Many independent contractors (or small business owners, for that matter) don't realize that there are certain caps on how much payroll an owner has to report on their workers compensation policy. Below is a guide to the amount of payroll you should put on your workers compensation policy. (Please note that each state can update their guidelines at any time, so refer to your state’s website for the most up-to-date information).

Advice For Employers

Your method of paying employees (W2 vs. 1099) does not determine their actual employee status.

One thing employers often get wrong is that how they pay for labor does not determine whether a worker is a 1099 independent contractor.

The determinant is the relationship you have with them, not how you write their paychecks. Not only is this true for workers compensation claims, but also for other parts of your business, such as IRS audits. If you have an employer relationship with a 1099 independent contractor, you are still responsible for them as if they were an employee.

Here are the factors that determine and categorize your relationship with your workers:

1. The nature of the contract between you and the independent contractor (IC) shows you are separate entities.

For example: Is there a written contract where you agree that the worker is an IC? Are they a corporation or limited liability company? Do they maintain commercial general liability insurance or other business insurance?

2. You exercise very little control over the IC’s work.

For example: By the agreement, do you (the employer) exercise control on the details of the IC’s work, or do they themselves retain the control? Does the IC create plans or specifications for the job? Does IC set their own work hours?

3. The IC is engaged in a distinct occupation or business for others.

For example: Does the IC work for companies or individuals other than your organization? Does the IC work for your competitors? Does the IC have a business logo or uniform?

4. The IC is a specialist who performs their work without supervision, and is not under the direction of your company.

For example: Does your company supervise the work of the IC?

5. The IC’s occupation requires special skills, licenses, education, or training.

6. Your company does not supply the things the IC needs to perform their job, such as tools and the workplace.For example: Does your company supply any of the materials or tools for the work? Does the IC operate a vehicle owned by your company? Was the work performed at the IC’s business or your company’s business location or jobsite? Does the IC wear a uniform supplied by your company?

7. The length of the job and how long the IC has worked for you does not resemble an employee.

For example: Is this a one-time job, or will the IC be performing this work for your company regularly?

8. The IC is paid as a separate contractor, not as an employee.

For example: Does the IC send you an invoice for their services? Is the IC paid by the job? Does the IC file a federal income tax return for their business? Do you send an IRS Form 1099 to the IC? Does your company pay the IC’s expenses?

9. The IC’s work is not the regular business of your company.

For example: Is the IC’s work customarily done in your company’s line of business or as part of your daily work? Has the IC ever been an employee of the Contractor? Do you work with other people hired by the Contractor on the work you perform?

10. The IC does not consider themselves an employee of your company.

For example: Will you withhold taxes or monies from the IC’s payment? Has the IC ever been an employee of your company? Has the IC or their employees ever filed an insurance claim against your company?

11. The IC does not have the right to terminate the relationship without liability.

For example: If the IC quits before the job is finished, is there a penalty?

Even if you add independent contractors to your workers comp payroll, you will be paying for all 1099 costs, not just labor.

One of the issues with including independent contractors on your workers comp payroll is that all costs are then added to your workers compensation audit, not just the portion allocated for labor.

For some companies, this isn't a big deal; but if you include costs like materials in the independent contractor's payment, those will be added to the payroll and can result in bloated costs.

Paying claims for independent contractors can harm your experience modifier.

If you are monitoring your experience modifier and attempting to manage claims as closely as possible, being liable for independent contractor injuries might not be in your best interests.

Companies are limited in the amount of oversight they provide to independent contractors (as discussed above) and that limitation also applies to certain safety procedures.

This creates a situation where you are liable for paying the claim but have very little ability to manage your risk, which can lead to an increased experience modifier.

If you hire too many uninsured independent contractors, insurance companies won’t insure you.

Insurance companies generally don't want to see uninsured independent contractors included on your workers compensation. Although many insurance companies will overlook the incidental use of uninsured 1099s, the story changes if they become a significant part of your payroll. You might be limited in the number of insurance companies that will insure you (leading to increased costs).

What penalties will employers face if they don’t get workers compensation coverage?

It is a serious risk and honestly not worth the gamble to bypass workers compensation coverage when you are legally obligated to obtain it. With 1099 workers that don’t meet the independent contractor guidelines, this can be a gray area. In most states there are penalties for not having workers compensation while you have an employment relationship with someone. For example, in Oklahoma, You’ll face these penalties if you don’t comply with the state’s workers compensation laws:

- Fine of $1,000 per day that you fail to provide workers compensation coverage to your employees

- Court-ordered shutdown of your business if you fail to provide coverage or pay the penalties

- Increased liability, leaving you financially vulnerable if a worker is injured and files a lawsuit

How much does workers compensation insurance cost?

This can vary dramatically from state to state, but average cost for workers compensation on an office employee can be less than 1% of payroll per month, whereas a high-hazard trade such as roofing can be as high as 10% of payroll. But this will vary depending on your specific business. These factors will be considered when pricing your premium:

- Number of employees

- Payroll

- Where your business is located

- Risk level of your industry and operations

- Coverage limits

- Claims history

Summary

Whether you are an independent contractor looking for a quote or an established company looking for help with understanding the rules around using 1099 independent contractors, let us know. We can have a conversation about how to minimize your insurance costs and lower the amount of risk in your operations.

About The Author: Austin Landes, CIC

Austin is an experienced Commercial Risk Advisor specializing in and leading LandesBlosch's design professional, real estate, and construction teams.