Commercial Insurance Renewal Process: An Overview

·

6 minute read

With emerging technologies, new start-ups, and an evolving marketplace, there are more insurance options and renewal philosophies than ever before.

In the overall market, and especially the small business arena, insurance companies and brokers are trying to automate and simplify the insurance renewal process via technology and "service centers."

This might be good for some, but not for every company.

Above all, your commercial insurance renewal process needs to involve a broker who understands your business operations and can help you manage business risk.

Need A Better Insurance Renewal?

We can help! Request a free quote now.

When should you start the commercial insurance renewal process?

Your renewal timeline depends on the size of your business, the complexity of your risk, and the insurance carriers.

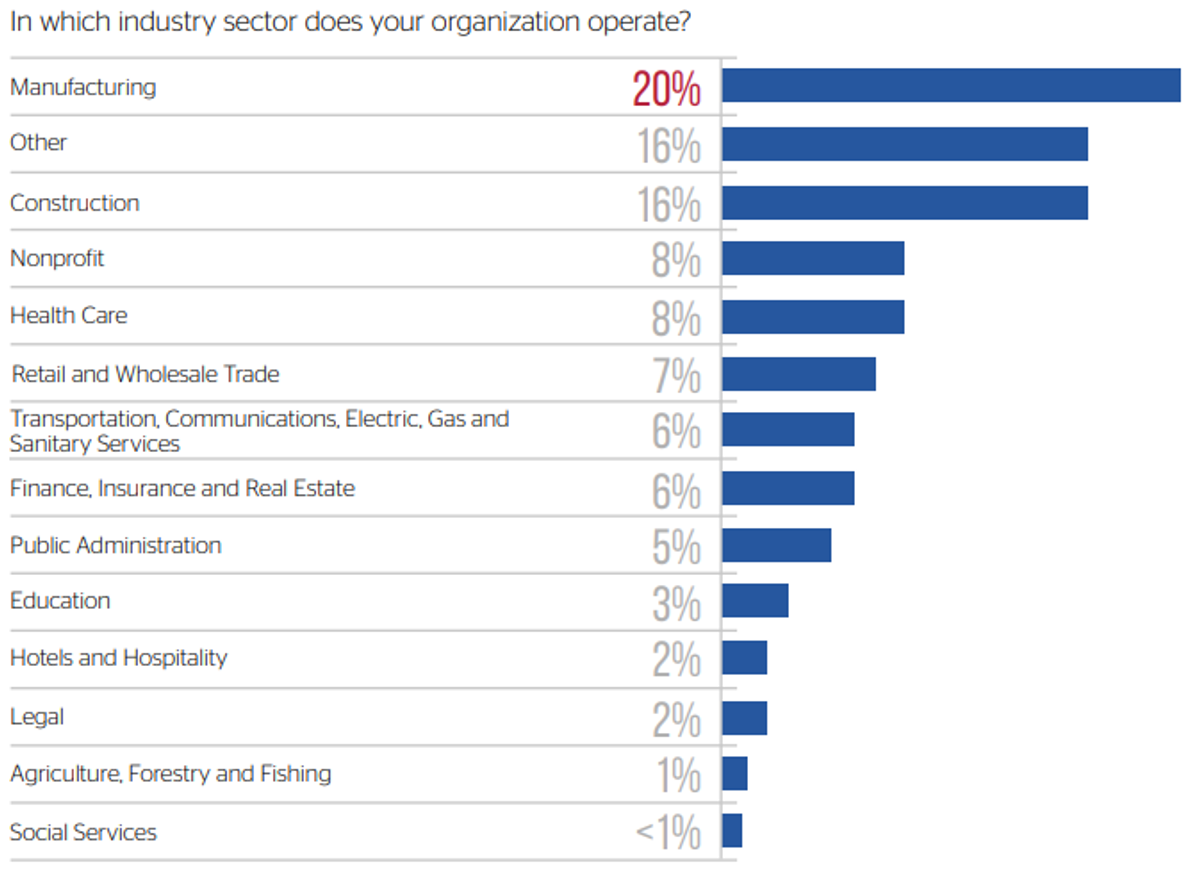

That being said, we wanted to know our clients' preferences on when to start the renewal process, so we partnered with Zywave to help us better understand their expectations. They received responses from around 400 businesses in the following industry sectors.

And the results were different than we expected

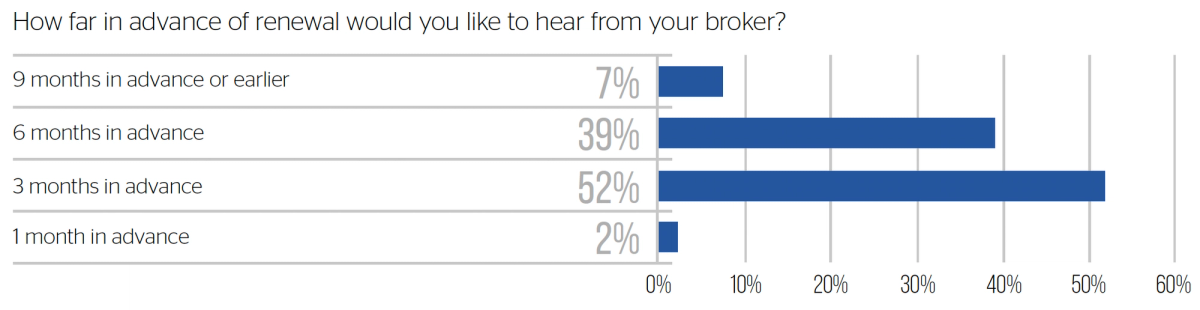

As you can see, 52% of our clients want to start the renewal process three months in advance, whereas only 2% wanted to start a month before the renewal date.

You might be thinking that three months in advance is a long lead time for your specific business. You might be a relatively low risk or need a simple insurance policy.

But there's a big benefit to starting conversations a few months in advance. We (and our clients) have noticed that it gives you time to talk about different issues and strategies with your insurance broker. You can discuss trends that could impact your business and the different coverages available.

Your business is your income, so taking the extra time to have these conversations about the renewal process in insurance will significantly benefit your organization for decades to come.

What do the renewal steps look like?

As mentioned above, most of our clients are interested in starting the commercial insurance renewal process three months in advance. So, what are the first steps to the process?

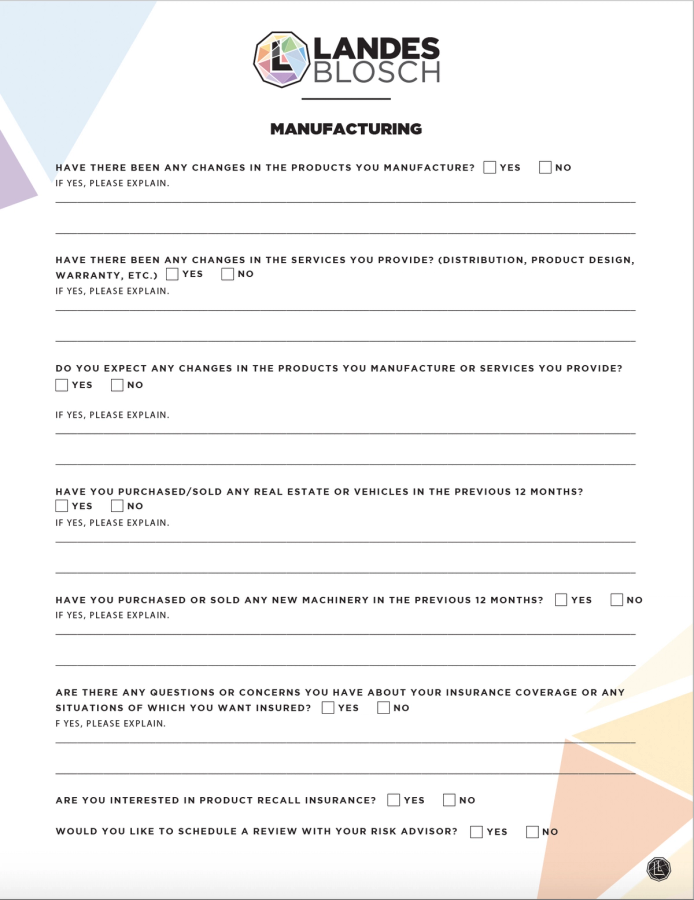

At LandesBlosch, we will send you a quick insurance policy review template (specific to your industry) that looks similar to this:

These questions allow us to understand what is needed in the upcoming months before renewal and plan for any changes to your business insurance program.

For example, many manufacturers will introduce new products in the scope of a year. Additionally, they might be anticipating a change in the products they produce in the next twelve months. It is important to update the carrier of these product changes or find a carrier that is better suited for your operations.

Once this industry questionnaire has been filled out and the scope of work established, we can create a renewal strategy.

For some businesses, the next three months will be uneventful, and for others, it will be packed with information gathering and risk management tasks.

Will my commercial insurance premium increase with renewal?

We will say it. Your insurance premium will most likely go up.

Rises in inflation, litigiousness in America, climate change, auto accidents, wild fires, hurricanes, and overall negative underwriting results are causing the insurance market to get tighter and it will continue to get tougher for the foreseeable future.

Expect your rates to go up and coverage terms to go down (or both). This is why you need an excellent advisor to manage your commercial insurance renewals.

Expected Renewal Terms - A great renewal is one you can plan for. Sometimes a price increase is inevitable, but it doesn't have to be unexpected. When renewing your insurance, you should know if your insurance policy is similar to the previous year and what the price difference will be. Additionally, you should know the market conditions and why your broker chose that particular insurance program.

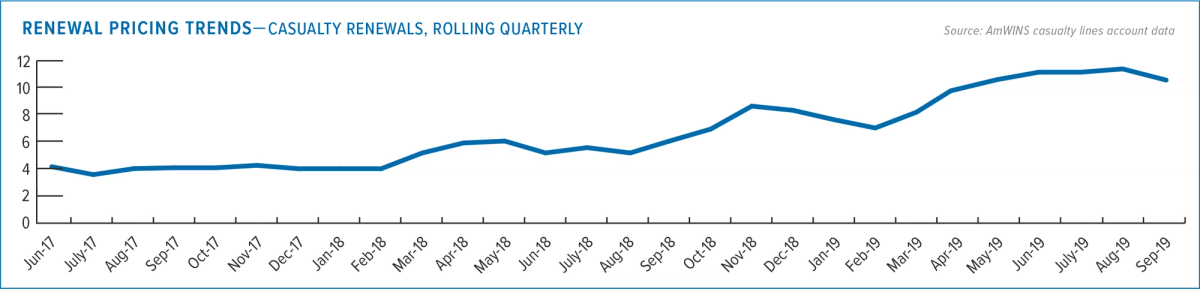

For liability policies, we typically expect to see rate increases of 6-10%.

AmWins State of the Casualty Market - Q4 2019

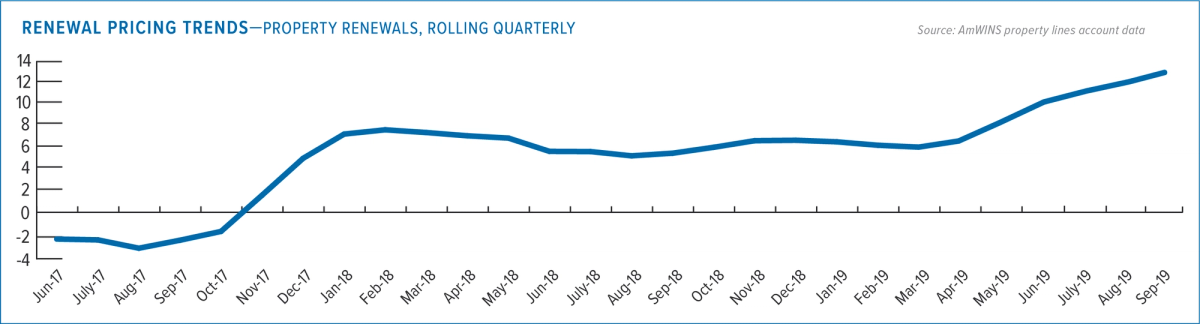

For your property insurance renewals, expect to see slightly higher increases, with rates increasing as much as 14% on average.

AmWins State of the Property Market - Q4 2019

The Unmanaged Renewal - A poor renewal is one that leaves you with no options, and you are made aware of any sharp increase in premium only days or weeks before the renewal date. Rate increases are impossible to avoid, but you should be made aware of any changes in coverage or premium well in advance.

An example of a poor renewal process is a building coverage switching to actual cash value instead of replacement cost. Another example would be a building deducible going from $5,000 to $25,000. Even though the premium didn't significantly go up, your exposure to loss significantly increased.

Summary

The commercial insurance renewal process will look significantly different for every business. Still, each renewal involves some common elements of exploring changes to your company and working with your broker to react to different market conditions.

About The Author: Austin Landes, CIC

Austin is an experienced Commercial Risk Advisor specializing in and leading LandesBlosch's design professional, real estate, and construction teams.