Business Insurance In Oklahoma - The Ultimate Guide

·

21 minute read

Oklahoma is a unique state with many challenges. With a deep history in the oil and gas industry, a significant aerospace presence, and a considerable amount of tribal land, Oklahoma is a state diverse in risk and opportunity.

LandesBlosch got its start in Oklahoma – we’ve been insuring businesses in the state since 1922! We know better than anyone the specific challenges and benefits of insuring a business here, and we believe the state has an excellent insurance market that can offer your business great terms and pricing.

Get Your Oklahoma Business Insured

Craft your perfect policy. Request a free quote today.

Here are some things you should know before getting a quote for business insurance in Oklahoma.

Top 5 Challenges For Business Insurance In Oklahoma

Wind And Hail Risks

One of the most pressing issues insurance companies (and their customers) face in Oklahoma is the significant exposure to our frequent hail damage and high winds. After all, we aren't called "Tornado Alley" for no reason!

Hailstorms, along with windstorms and tornadoes, have taken a toll on our insurance market. Many carriers are now refusing even to participate.

The remedy to this is to either raise prices, limit coverage, or some combination of both. Each insurer has its own philosophy on which combination to use, but below are the popular ones:

Separation Between Wind/Hail And All Other Perils Deductibles

On a traditional insurance policy, there is a single property deductible. This deductible is the amount you will pay out-of-pocket in the event of a covered claim. Insurance companies use this as a tool to ensure you share in some of the risk – giving you an incentive to avoid claims.

Additionally, it is not efficient to use insurance to pay for incredibly minor damage. The insurance processes and claims adjusters bloat the process – plus, it was never intended to be used like this. A property deductible keeps the insurance policy from being treated as a maintenance policy.

Due to the frequent wind and hail events in Oklahoma, insurance companies have separated out the perils resulting from wind or hail damage and put those risks on a separate deductible. This deductible is almost always higher than the primary deductible – often 2-10 times higher. This is to cut down on these types of losses, as the frequency of these events makes it a hard risk to insure against.

Actual Cash Value On The Roof

In addition to the deductibles mentioned above, another way insurance companies can lower the costs of claims is to change the way they calculate the value of your roof.

On a replacement cost policy, the insurance company will pay to fix or replace the roof with brand-new materials and labor. This is the type of policy you generally want on your building.

On certain policies, insurance companies are now saying that they will pay replacement cost on your building, but evaluate your roof on an actual cash valuation. This means the insurance company will take the replacement cost of your roof and subtract depreciation (or the useful life left on your roof). Not only will you get less money in a claim under this policy, we feel that the process is very arbitrary. After all, how does one determine the useful life left on a roof? We don't believe this can be done with much accuracy, and it can often leave you feeling ripped off.

Cosmetic Damage Exclusions

In addition to the tools mentioned above, insurance companies are adding something called the "cosmetic damage exclusion."

This exclusion states that if your roof looks damaged by hail but is still 100% functional, your claim will not be covered. This exclusion is often added to metal roofs that are prone to dings. This exclusion is often unavoidable. On the flip side, it is sometimes not as serious as the other problems with wind and hail.

This is all far from ideal, but Oklahoma is far from the worst state when it comes to insurance. Many coastal regions exclude wind completely and you have to purchase it back on a separate Lloyd's of London insurance policy (this is not cheap!). We have also seen wind deductibles go as high as 10% of the total insured value in some coastal regions.

While we aren't there by any means, managing your wind and hail insurance is an important part of your Oklahoma commercial insurance program.

Auto Liability And Uninsured Motorists

The commercial auto insurance market has had massive difficulty remaining stable in the U.S. We are seeing claim amounts increasing faster than insurers can increase premiums, causing a significant shift in the commercial auto insurance market.

To summarize Insurance Journal's recent article, "U.S. Commercial Auto Insurers Report Worst Losses in Decade: AM Best," the commercial auto insurance market hasn't been profitable since 2010. To top that, 2019 was the worst year on record.

Many in the industry contribute this phenomenon to "social inflation." While this might be

the primary driver, it is likely a combination of hundreds of things, such as higher medical costs and newer vehicles being more expensive to repair.

In Oklahoma, many insurance companies that used to specialize in commercial auto insurance are now requiring that you bundle it with other lines of coverage to offset the losses. Many have quit writing auto insurance completely.

What makes Oklahoma particularly vulnerable to these commercial auto problems is the 600,000 estimated uninsured drivers on the road. To make matters worse, the state minimum limits in Oklahoma are only $25,000 of bodily injury protection per person, $50,000 per accident, and $25,000 of property damage protection.

As we mentioned above, medical procedures are becoming costlier, and newer cars are getting more expensive to repair (without even accounting for social inflation). Ultimately, $25,000 does very little to help after a significant accident.

This leads to the people and companies that purchase adequate insurance to bear the costs associated with the uninsured, or the people that purchase low limits.

Since Oklahoma has such low limit requirements and such a high uninsured population, this increased cost is more magnified than in many other states.

Energy Or Aerospace Risks

The energy and aerospace industries are considered Oklahoma’s core sectors. Many businesses, even though they aren't in these industries, serve them in some capacity.

For example, a machine shop might have many clients throughout the state, but chances are they will also machine a part used in the oil and gas industry.

The reason we are singling out energy and aerospace is that these industries are particularly challenging to insure. Your business might only do 15% of this type of work, but the fact that you’re involved in it at all means most insurance companies will not cover you.

This is in large part due to the higher risk these industries take part in. It’s also due to certain agreements that insurance companies have with reinsurers (the insurance companies that insure insurance companies), which prohibit them from taking on these clients.

This creates a situation where even though the underwriter understands that your business is not high risk, they cannot underwrite your insurance due to these agreements with reinsurance companies.

This can limit your potential insurance carriers to those that accept these types of risks, and thus can potentially increase your insurance premiums.

We often rely on regional insurance carriers to fill in these gaps. Regional insurance carriers work well because they operate in fewer states. Local insurance companies such as NAICO (Chandler, OK) or Mid-Continent Group (Tulsa, OK) understand that a "no energy" policy would significantly reduce their ability to have customers in the region.

Insuring Tribal Businesses Can Require Regional Expertise

Business liability insurance is rated based on U.S laws and court costs. In many places in Oklahoma, each tribe can have their own court system and unique set of laws. This makes it difficult to determine what the cost of liability protection should be.

Additionally, many tribes require that their contractors take out construction surety bonds promising payment if the contractor is unable to complete the job.

These bonds are often more difficult to source for tribal-related projects and require you to know the right underwriters to get them.

Top 2 Benefits Of Insuring Your Business In Oklahoma

1. It’s less litigious than many other states.

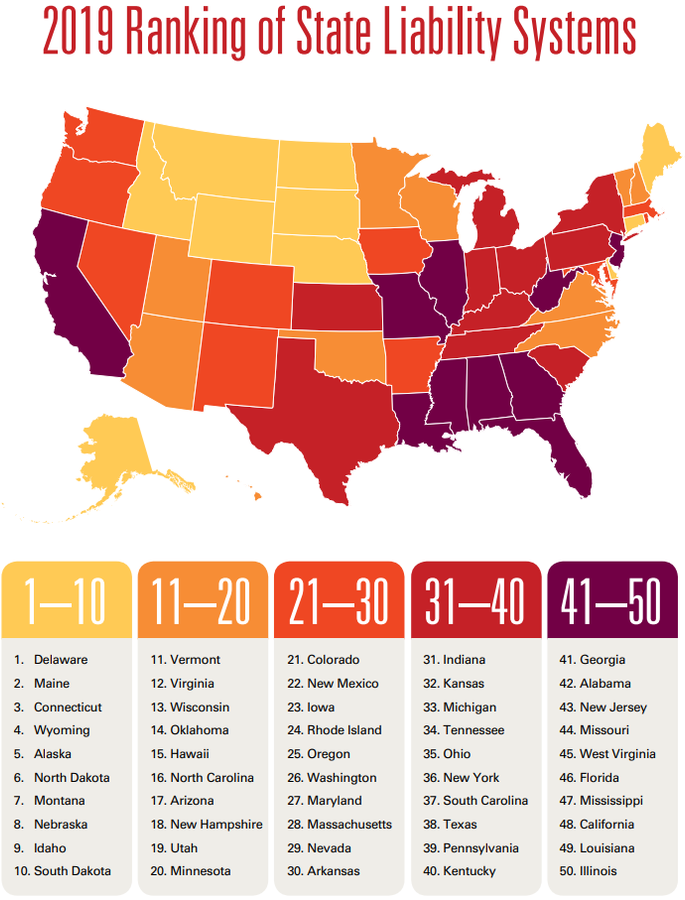

Let’s take a look at the U.S. Chamber Institute for Legal Reform’s recent publication, "2019 Lawsuit Climate Survey: Ranking the States." In it, each state is graded on factors like fairness, judges, processes, and overall treatment of torts.

Here are the results:

As you can see, Oklahoma has the 14th highest-rated court system in the country. Below, you’ll note that we are ranked #1 for juries' fairness.

As we discussed in our previous insight about business catastrophe liability, social inflation is a driving factor in nuclear jury verdicts. Some of these verdicts are reaching up to $100,000,000.

Being in the state with the highest-rated jury fairness rating will continue to be one of our most valuable assets moving into the future, and create an attractive place for businesses. It will also create a more competitive insurance market.

This is also why our liability rates aren't as expensive as some other areas.

2. It’s not exposed to most catastrophic events (earthquakes, hurricanes, and wildfires).

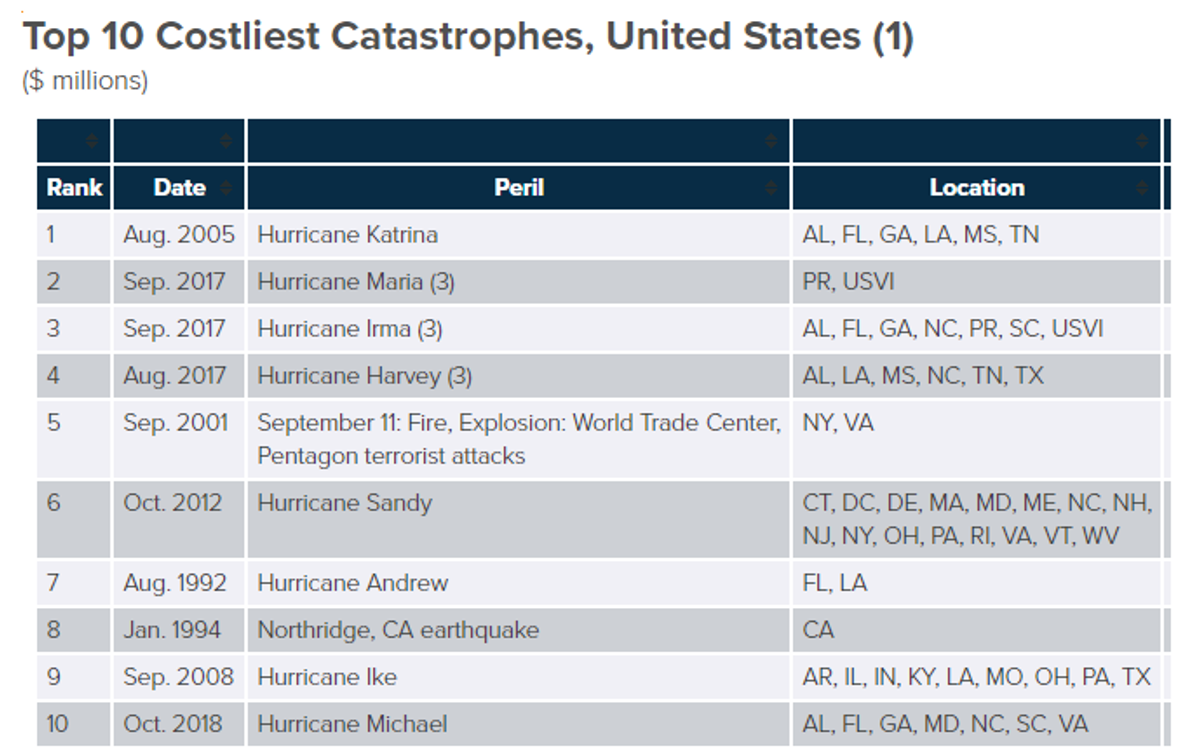

Catastrophic events can occur in Oklahoma, but if you look at the “Top 10 Costliest Catastrophes in the United States,” you’ll see we aren’t included.

*Insurance Information Institute

Being so far inland, we are not heavily exposed to the hurricanes that account for eight of the top spots. If we are affected by a tropical storm, it is not nearly as destructive as it was when hitting more coastal areas.

Additionally, although Oklahoma has experienced a rising number of earthquakes in the

past couple of years due to different energy-related processes, most of them are small and result in no or minimal damage.

Our Top 3 Tips For Insuring Your Property In Oklahoma

1. We suggest a flat wind and hail per occurrence deductible, if possible.

Due to the high winds and the hailstorms that are common in the state, you will most likely see a separate wind and hail deductible. The insurance companies will also try to make the deductible on a per building basis instead of a per occurrence basis. “Per occurrence” simply means “per event,” so one storm or one fire would be considered one occurrence.

We suggest that you first look for non-percentage wind and hail deductible. Although these are sometimes hard to find, there are options, especially if you have a roof in excellent condition.

Percentage Vs. Flat

Example Of A Percentage Deductible:Deductible (All Other Perils) – $5000Wind And Hail Deductible – 2% of Insured Building Value

Example Of A Flat Dollar Amount Deductible:Deductible (All Other Perils) – $5000Wind And Hail Deductible – $10,000

Per Occurrence Vs. Per Building

If you had three buildings that were within close proximity of each other and a windstorm came through that did significant damage to all three buildings, it would be preferable to have a “per occurrence” deductible instead of a per building deductible. Not does this lower your total out of pockets expenses in most cases, it also allows you to financially plan for a disaster more easily.

Here is what we mean:

Percentage Deductible Vs. Per Occurrence Flat Deductible

Example Of A Per-Building Deductible:Deductible (All Other Perils) – $5000Wind And Hail Per Building Deductible – $10,000For each building, for the same storm, you would be out of pocket for $10,000. This leads to a total of $30,000 out-of-pocket deductible costs.

Example Of A Per-Occurrence Deductible:Deductible (All Other Perils) – $5000Wind And Hail Per Occurrence Deductible – $10,000In this scenario, since each building was damaged during the same storm, they are all covered by the same occurrence deductible. You are only out of pocket for $10,000 per storm.

This is why we like flat deductibles that are on a per occurrence basis. You can plan for your maximum out-of-pocket expenses during a storm of any severity.

2. If your roof is under 10 years old, do not settle for actual cash value.

As mentioned above, insurance companies are adding a condition to the policy that while they will pay the replacement cost for the house, they will only offer actual cash value for the roof replacement. This is because roof claims are the most common and expensive claims in Oklahoma.

This condition is hard to avoid if your roof is over 10 years old. But if you have a newer roof, you can most likely find an insurance company that will agree to replacement cost terms.

If you have a roof under 10 years of age and have an actual cash value policy on the roof, let us know!

3. If your building is over 20 years old, purchase significant ordinance and law coverage.

Building laws and codes change incredibly fast in Oklahoma. A building constructed 15 years ago would not be up to code if it were built today.

This leads to a problem: If you experience a loss, the insurance replaces your building with one of similar construction and materials. Bringing an older building up to code would be considered an upgraded cost that wouldn't be covered under your primary insurance limits.

This can be especially shocking when only half of your building is destroyed and the government requires you to tear down the undamaged portion because it does not meet code.

Insurance covers damaged property, not property the state tells you to demolish.

Ordinance and law coverage will pay for the upgrades you need to bring your building up to code after a damaging event. Additionally, it can pay to demolish and rebuild the portion of your building undamaged by the initial event – the portion the government told you to destroy.

Our Top 3 Tips For Insuring Your Oklahoma Business Liability

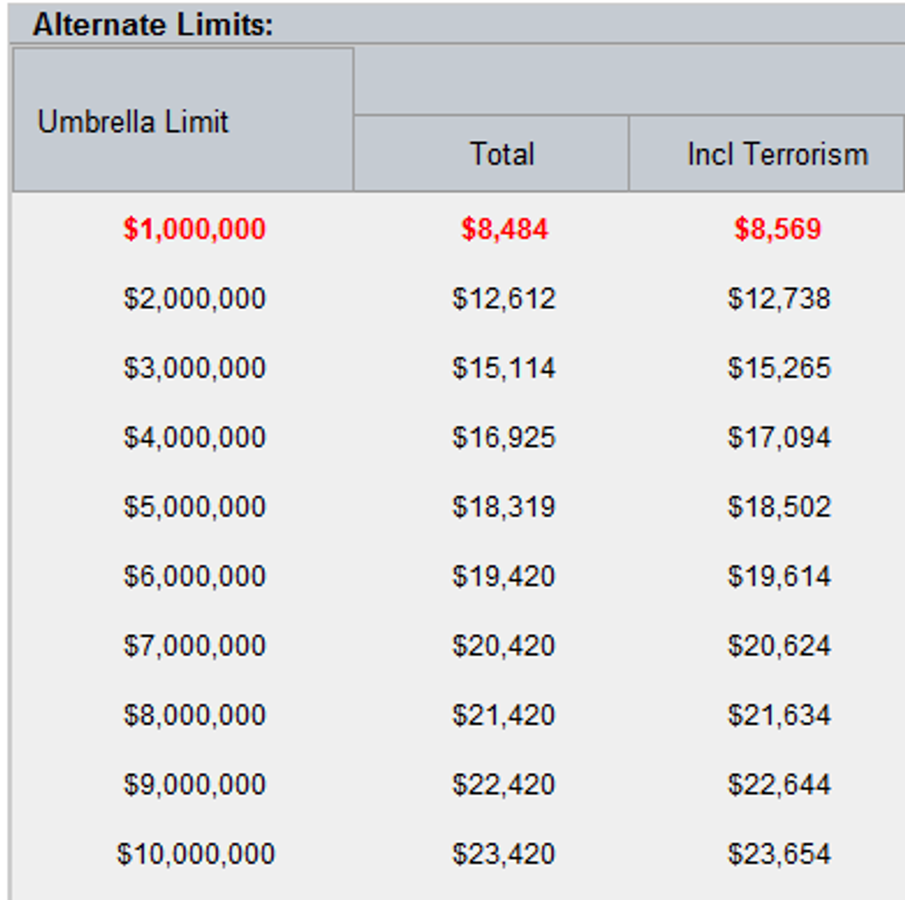

1. Always get the price on an umbrella policy. It might cost less than you think.

Many businesses in Oklahoma assume that purchasing additional liability limits will double or triple the cost of their liability insurance.

This is not the case.

This particular Oklahoma umbrella quote extends over the workers compensation, auto liability, and general liability.

This client's underlying liability policies are also nearing $50,000.

With each million you go up in coverage, the price per million decreases. This is because statistically, claims are less likely to reach those amounts.

The smaller your liability policy premiums are, the lower an umbrella would cost per million in coverage.

2. Look for subcontractor exclusions on your liability policy.

Due to the heavy use of subcontractors in Oklahoma, insurance companies have been adding an exclusion that eliminates coverage for any damages arising out of your subcontractor’s work.

In many cases, this exclusion can be negotiated off the policy; you may also be able to find an insurance carrier that does not include it. We suggest that you at least try to get this removed, although, if you can’t, verifying the insurance of your subcontractors and having them add you as an additional insured on their liability insurance can help mitigate this risk significantly.

3. Add the "liability enhancement endorsement" that the carrier offers.

Each insurance company generally has a generic enhancement endorsement for your industry or for your business size. This bundle of coverage is most likely a flat charge and includes all the most common "add-ins" at a significantly lowered price.

Usually this includes additional insured endorsements, waiver of subrogation endorsements, expanded definitions, and much more. You never know when you will need one of these forms; paying $100 at the beginning of the year is a better deal than amending your policy after the fact.

3 Current Trends In Oklahoma

1. Wind and hail deductible buydowns are becoming more common.

As mentioned above, most insurance companies are increasing their deductibles on wind- and hail-related claims. Because of this, a new type of policy has emerged: the deductible buydown.

This is a separate insurance policy that you can leverage to cover the gap between the deductible you want to purchase and the deductible your primary insurance company offers.

Usually, it is a little more complicated when you have multiple buildings, but an example would be your primary property insurance company offering a $100,000 wind and hail deductible. You can purchase this buydown policy to lower the deductible to $5,000; in the event of a claim, it will pay the $95,000 owed to your primary insurance company.

2. Some companies are no longer accepting the affidavit of workers compensation insurance.

In Oklahoma, if you do not have any employees, you are not required to purchase insurance on yourself. In order to bypass this requirement, you needed to get what’s called the Affidavit

of Exempt Status from the Workers’ Compensation Commission.

In the past, most general contractors, customers, and project owners have accepted this affidavit and waived the workers compensation requirement. Lately, we are seeing companies reject this affidavit, forcing their smaller contractors to purchase a workers compensation insurance policy or not work for them.

3. Our clients’ customers are starting to ask for unrealistic certificates of insurance.

We are starting to see certificate requests and contracts that our clients have signed that state their insurance will cover certain things that will never be covered. A popular example of this is "XYZ will purchase an insurance policy that will cover all liabilities in the scope of their work" and will request similar wording on the certificate of liability insurance.

No insurance company would ever agree to this, nor should you ever enter into a contract that promises such a thing. It is simply too broad to be guaranteed. Additionally, after a couple phone calls, we can generally get the company to lighten up on the compliance terms.

Recommendations For Insurance Carriers In Oklahoma

Due to the large number and diversity of businesses in Oklahoma, we cannot give a specific insurance company recommendation until we know more about your company’s operations. Most likely, your insurance program will even encompass three or more insurance policies from different insurance companies to get the best value for your premium.

Whether you need a NAICO quote because you service the oil industry, a Hartford small business insurance quote for your accounting firm, or Hiscox business insurance to cover your professional liability risks, you have plenty of options if you are working with a broker with experience in Oklahoma.

Conclusion

Oklahoma is a unique state with a unique set of hazards, and we hold insurance policies up to standards that other states don’t. Whether you are a new start-up or an established business, if you need to talk to an Oklahoma insurance expert, let us know. We will review your operations, risks, and assets to find a policy that best fits your needs.

About The Author: Austin Landes, CIC

Austin is an experienced Commercial Risk Advisor specializing in and leading LandesBlosch's design professional, real estate, and construction teams.