Business Insurance For Remodeling Companies - Explained

·

9 minute read

Remodeling contractors have incredibly diverse risks. Not only do they have to manage subcontractors, sell their services to customers, and design the remodel—they also need expertise in a wide variety of trades to successfully complete a project.

That is also why remodeling contractors are far more difficult to insure with the right coverages and a fair price, compared to some of their trade contractor counterparts. Here are some of the problems remodeling contractors might face and how to address them:

Common Insurance Issues For Renovation And Remodeling Companies

Incorrectly Classifying Workers’ Compensation

It can be difficult for remodeling and renovation companies to classify their workers’ compensation codes. Although it might be tempting to choose the cheapest classification, this is almost never the best method.

The problem is that each remodeling company has differing class codes based on what they do, should it be residential remodeling, commercial renovation, interior remodeling, structural remodeling, or very light work (such as painting and light fixtures).

If you choose the lowest-rated classification code and an auditor chooses a different class code during an audit, it oftentimes results in a large premium increase.

Our Recommendation: Make a list of all the work you performed in the previous year and the type of work that’s required of your employees. After completing that list, assign each one of those tasks to a workers’ compensation class code.

After identifying your proper class codes, you can either keep track of how many hours your employees are spending doing each type of work, or you can lump all the payroll into the highest-rated classification code.

Ready To Get Started?

Get affordable remodeling insurance options today. Available in most states.

Getting Inaccurate Quotes From Insurance Companies

When a remodeling company requests a quote on insurance, the insurance company often doesn't understand what they are insuring because the operations of a remodeling company can differ so widely (framing, roofing, painting, electrical, plumbing, etc.).

This often results in high pricing and a lot of exclusions you do not want.

Our Recommendation: Have an extensive description of the work you completed in the last year, what jobs you are currently pursuing, and what jobs you decline(d).

This will help the underwriters understand the scope of what you are doing and help you get a policy suited for your business.

Receiving Policies With Too Many Exclusions

Remodeling contractors have some of the longest exclusion lists in the insurance industry. This happens not only because underwriters feel like they don't understand a specific remodeling company’s operations, but also because they have experienced significant claims from remodelers.

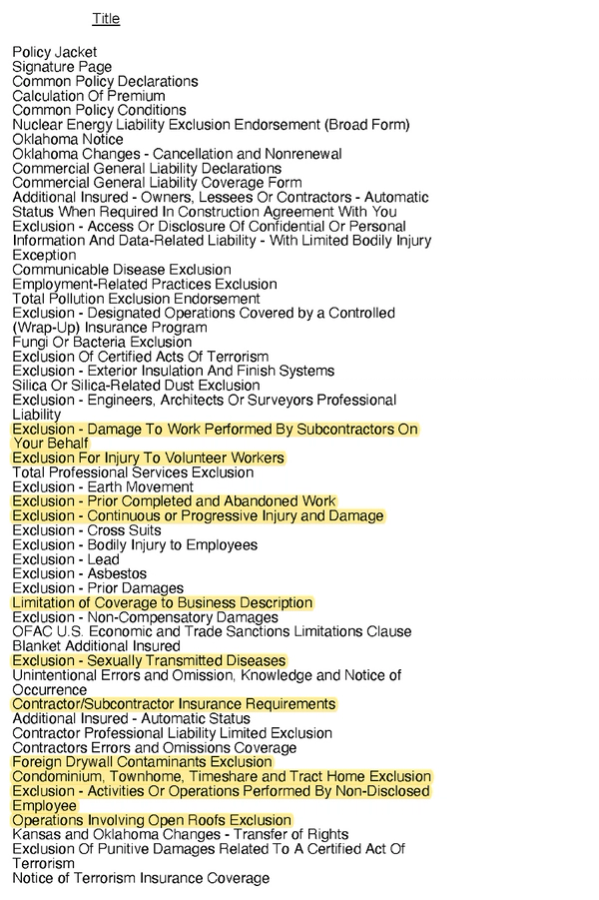

Here is a real-life example exclusion list for a remodeling company:

The above example was quoted for a remodeling contractor through one of the popular online insurance companies. As you can see, insurance companies will often attempt to exclude any liability they can when dealing with the remodeling and renovation industry.

Every policy will have exclusions, but some policies have much more than others. Highlighted above are exclusions that aren't typically included on other policies (e.g. why is there a sexually transmitted disease exclusion on a contractor policy?). Joking aside, there are some exclusions in the example that can be very bad for your business, such as the “Limitation of coverage to business description.” Some of these exclusions I have never encountered in my career! The lesson here is to thoroughly read through your policy.

Our Recommendation: Our recommendation is to take your time and partner with an insurance provider that will learn about your business instead of automatically adding every exclusion available to the policy.

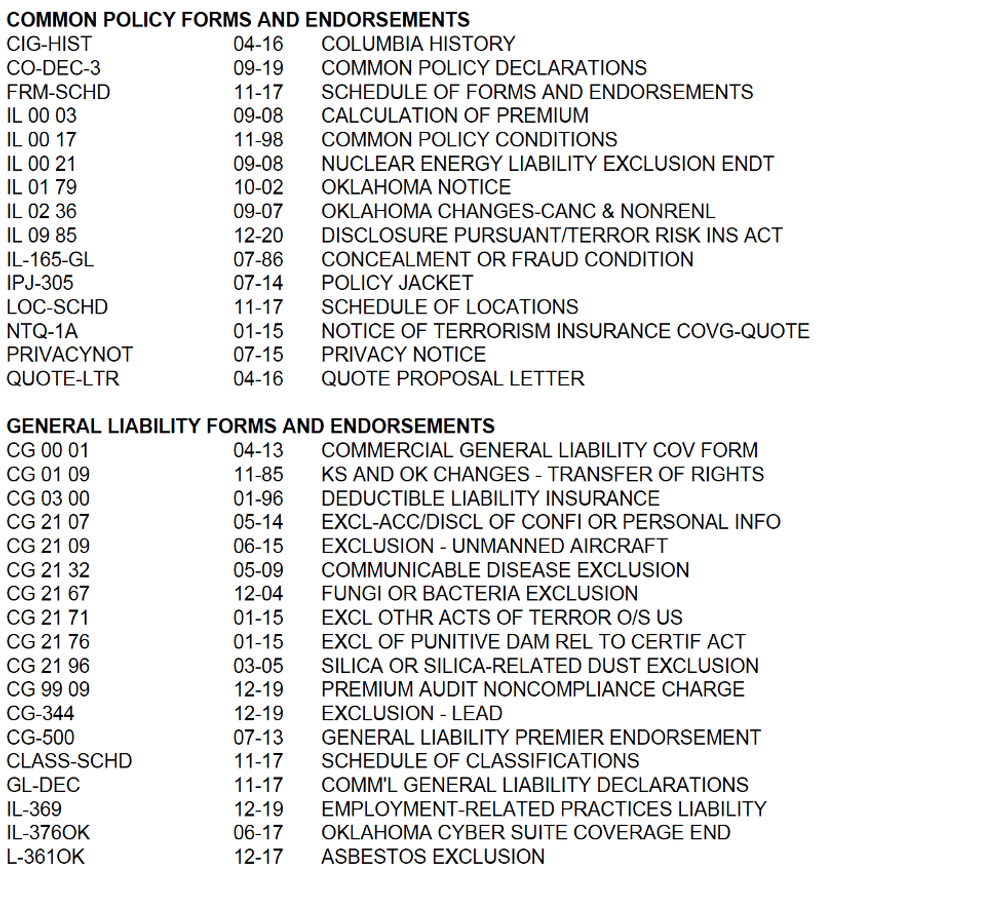

For the remodeling company in the example above, we were able to find a regional insurance company to provide coverage. The underwriter worked through the operations of the remodeling company and trusted the customer's promises on the work they were performing. The process took a couple of weeks longer, but the result was a more affordable, broader policy with very few exclusions. Below is the forms schedule of the better quote for you to see the difference.

Combating Insurance Company Stigmas Against Heavy Subcontractor Use

Insurance companies are always nervous about heavy utilization of subcontractors. There is a much higher number of carriers willing to write a policy with a contractor that subcontracts under 30% of their work. Anyone who subcontracts more than this baseline percentage will find difficulty getting coverage. This is even true if all your subcontractors have liability insurance and add you as additional insured.

Since many remodeling contractors utilize subcontractors for well over 30% of their work performed, this is a real problem when trying to get insurance, since there aren’t many options.

Our Recommendation: Convey to your insurance broker the controls you put in place for subcontractors, how you oversee the subcontractors, and if they have been working for you over a long period of time.

Additionally, collect liability certificates from all of your subcontractors with you listed as an additional insured to make your business stand out among the other insurance submissions.

Types Of Insurance That Remodeling Companies Need

General Liability

Every remodeling company needs general liability insurance. This insurance covers property damage or bodily injury resulting from a project.

One of the most important coverages in a general liability policy for a remodeling contractor is "Completed Operations," which covers your work after completing the job.

For example, if a mistake you made in a bathroom remodel caused the plumbing to leak a few weeks after the project ended, resulting in water damage to the building, completed operations coverage would cover that damage.

Workers’ Compensation

Although workers’ compensation is necessary to protect your business from risk, it is also required by law in most states.

This policy would cover your employee's medical bills and lost wages if they were to get injured on the job. This is a big deal for remodelers, and the construction industry as a whole, as the industry accounts for a significant amount of workplace injuries.

Commercial Auto

If you have any type of work truck or work van, you should get commercial auto liability insurance. This protects from the damages you cause due to an accident and also covers damage that happens to your vehicle, regardless of fault.

Specifically for remodeling contractors, we suggest adding hired and non-owned liability insurance to your policy. This covers the liability that you could be responsible for due to a vehicle that you do not own. For example, if a subcontractor gets in an accident to your job site, this policy would defend your company if you were sued.

Beware of "quick and easy" quotes!

For many industries and businesses, getting a quick and easy online quote is a great idea. For remodelers, you might run into one of the quotes that we saw above with a ton of exclusions.

When getting insurance, you need to take your time and give yourself at least a week of two to find something good. Because once you find a quality policy, you can renew it each year with little to no additional work.

And usually, the price difference between a quality policy and a bad one is minimal or no difference at all.

Summary

Remodeling contractor insurance can be challenging, but not if you have a game plan:

- Give your insurance broker at least a week to find you a quality policy

- Read the exclusions on your general liability policy

- Have documentation of what type of work you are doing

If you are interested in getting a quote on your remodeling business, let us know.

About The Author: Austin Landes, CIC

Austin is an experienced Commercial Risk Advisor specializing in and leading LandesBlosch's design professional, real estate, and construction teams.